Trading Strategies

January 11, 2021 2025-09-07 8:40Trading Strategies

#1 Forex Trading Strategies

What is a trading strategy?

Your gut feeling is no expert when it comes to trading stocks, currencies, etc. But you can trade like a pro by learning & experimenting with different trading strategies.

How to use trading strategies

Expert traders are well-versed in the art of carrying out extensive technical analysis. They may have a working knowledge of different trading strategies, but they usually settle on a few strategies that they have found to be successful on a consistent basis.

You should approach trading the same way. Having well-laid out rules that govern when you enter and exit trades keeps you from making emotional decisions. Remember, gut decisions bring the highest losses as trading is never a sure game. Even after using trading strategies, the outcomes may at times go against you.

Put your strategy to the test in a risk-free environment

You’ll have varying levels of success when you implement any new strategy. If you put real money on the line with an untested strategy, it can result in losses. That’s why the best approach is testing out strategies in a demo environment.

Trading with a demo account may be devoid of the emotional highs or lows that come with losing or making real cash. However, it’s still the best way to know if strategies might work in a real-life scenario.

Some strategies are advanced and require some practice. Another advantage of trading in a demo environment is that you have access to historical market movements. You can apply a strategy and see what the outcome would have been.

Join over 190+ partners around the world

Learn The Essential Skills

Earn Certificates And Degrees

Get Ready for The Next Career

Master at Different Areas

Different forex trading styles!

Trading courses taught by the best instructors

Diversification as a market strategy

What you'll learn

Virtual Private Servers (VPS)

What you'll learn

Expert Advisors (EAs)

What you'll learn

Advanced news trading strategies

What you'll learn

How to use trading strategies

Expert traders are well-versed in the art of carrying out extensive technical analysis. They may have a working knowledge of different trading strategies, but they usually settle on a few strategies that they have found to be successful on a consistent basis.

Frequently Asked Questions

What is the 3-5-7 rule in trading strategy?

Applying the 3-5-7 Rule is simple. Start by checking your current trades: are you risking more than 3% on a single trade? If so, scale it down. Make sure your exposure to any one market stays within 5%, and keep your total risk under 7% to avoid overexposure.

What is the 90-90-90 rule for traders?

It is a high-stakes game where many are lured by the promise of quick riches but ultimately face harsh realities. One of the harsh realities of trading is the “Rule of 90,” which suggests that 90% of new traders lose 90% of their starting capital within 90 days of their first trade.

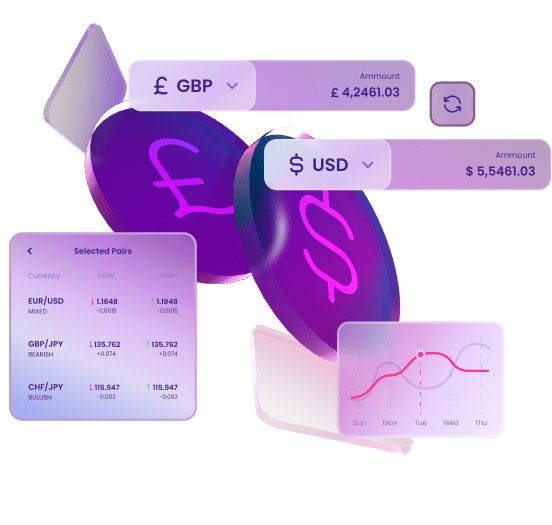

What is the 5-3-1 rule in trading?

The numbers five, three and one stand for: Five currency pairs to learn and trade. Three strategies to become an expert on and use with your trades. One time to trade, the same time every day.

What is the 70 30 trading strategy?

It involves buying assets when the RSI hits 30 and selling when it reaches 70, which are considered oversold and overbought signals, respectively. For example, if a stock’s RSI drops to 25, this might be a good buy opportunity anticipating a price increase. The strategy advocates conducting thorough market analysis.

All about Parabolic SAR!

Parabolic Stop and Reverse

The parabolic SAR is a “trend-following indicator.” It can help you decide when to buy or sell. The indicator appears as a series of dots above the price bars. Day traders use it to uncover short-term momentum.

How to use Parabolic SAR

Using the parabolic SAR is quite easy, even for beginners. However, note that like other indicators it may produce fake signals. When the dots are above the price line, look out for an uptrend as it may be likely to form. The dots just make the price movement clear. Dots swap from the top of the price to the bottom of the line to reveal potential entries and exits.

Ichimoku Hyo Indicator

The indicator was developed by a Japanese newspaper writer, and it’s a combination of several indicators meant to give traders all the information they need in one glance. It’s no surprise that it consists of up to 5 lines. Since it’s made up of multiple lines, it can be hard for novice traders to read it.

How to use Ichimoku Kinko Hyo

Without getting into the technicalities, this indicator helps traders determine resistance and support levels. It may reveal the price momentum, possible reversals and help traders place a stop loss.

Some of its lines include the kijun-sen and tenkan-sen that are derived by averaging the highest prices and lowest prices of different lookback periods. For instance, the tenkan-sen line has a lookback period of 26. The senkou span A, another line, is the average of the kijun-sen and tenkan-sen.

New to Markets is Powered by The Octalas Group Limited.