ChatGPT prompts to enhance trading

ChatGPT prompts to enhance trading

What if a single tool could sharpen your trading edge in seconds? Explore actionable ChatGPT prompts that can streamline your workflow and decision-making while implementing expert insights and advanced tools and platforms.

Understanding ChatGPT’s role in trading process

ChatGPT is a powerful tool for improving decision-making, streamlining market analysis, and automating aspects of your trading workflow. It can generate insights based on historical data, suggest trading strategies, and help interpret complex market trends. However, for a more well-rounded approach, it should be used alongside expert market analysis and traditional research rather than as a replacement for human judgment. For deeper insights, you can complement AI-driven analysis with expert commentary like Today Markets market insights.

This article introduces specific, actionable prompts that can be directly implemented to enhance your strategy, offering clearer and more practical guidance.

**Disclaimer: **The prompts provided in this document are for illustrative purposes only and are intended to serve as a starting point for your research and analysis. While these prompts can help guide your investment and trading decisions, they should not be considered as financial advice. Users are encouraged to enhance, adapt, and tailor these prompts based on their individual needs and objectives. It is important to conduct thorough research, consider various sources of information, and consult with a qualified financial professional before making any investment decisions.

Using ChatGPT for market analysis

Market analysis is the foundation of informed trading, that helps you navigate volatile markets and make strategic decisions. ChatGPT can assist in this process by providing real-time insights, data-driven summaries, and sentiment analysis.

By leveraging ChatGPT for market analysis, you can streamline the research process, uncover valuable insights, and make more confident trading decisions.

Step-by-step market analysis process

1. Identify market-wide trends

| “What are the current economic trends affecting stock markets worldwide?” |

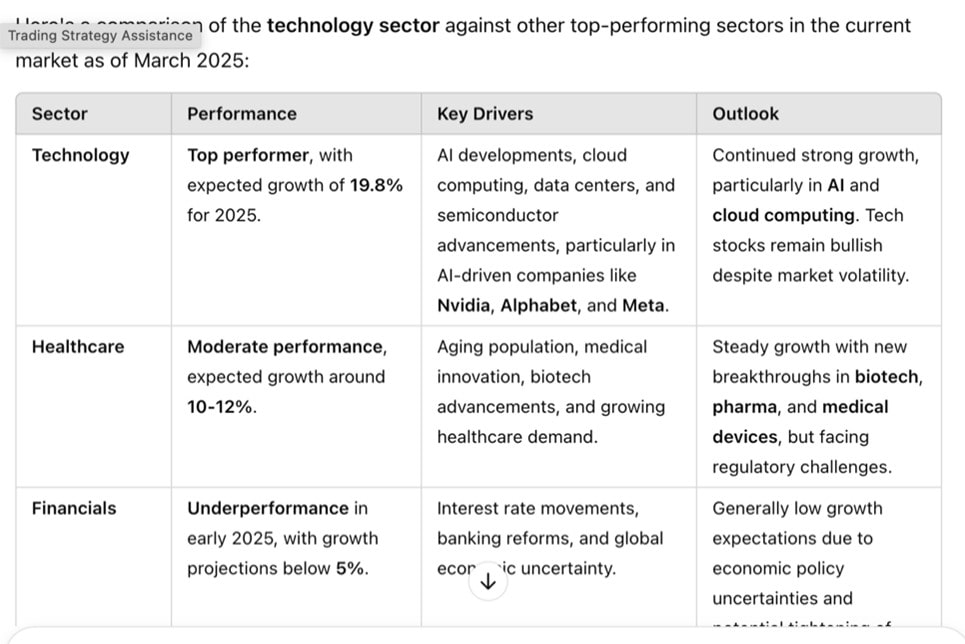

2. Find top-performing sectors

| “Which sectors are outperforming in the current market cycle?” |

3. Analyse specific stocks

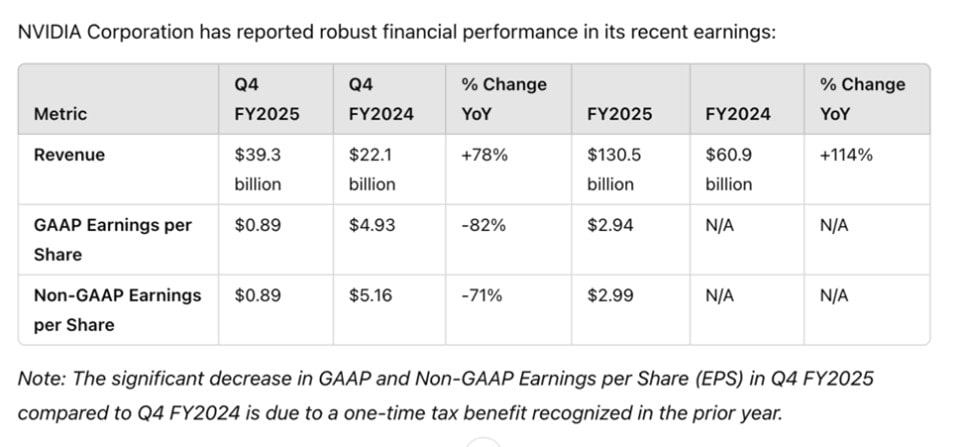

| “Summarise the financial performance in table form of [stock name] based on recent earnings reports.” |  |

4. Compare trading options

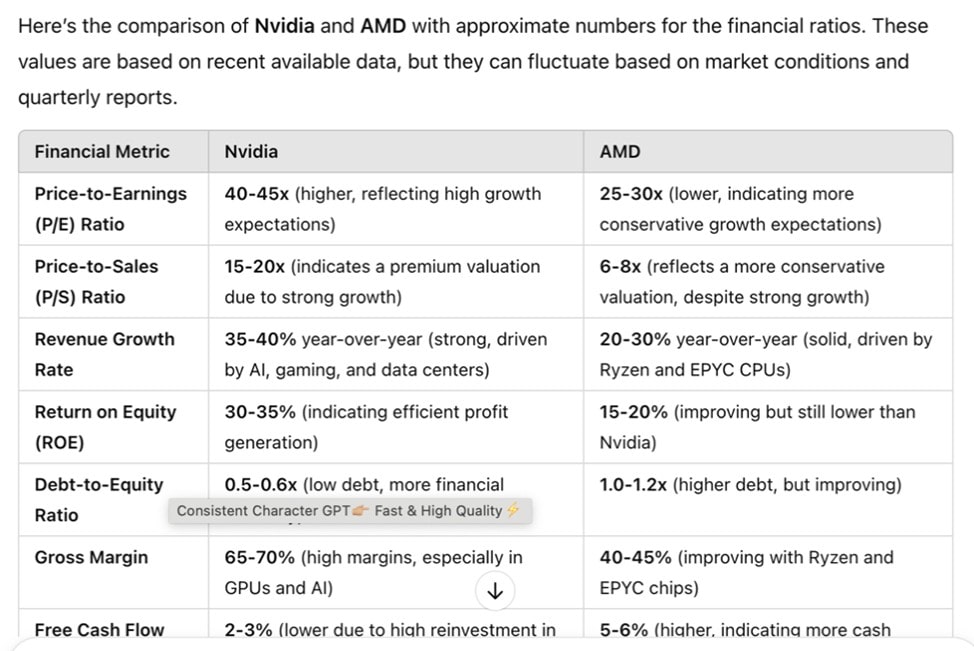

| “Compare the growth potential of [Stock A] and [Stock B] based on financial ratios.” |  |

5. Market sentiment analysis

| “Summarise recent analyst opinions and market sentiment on [sector/stock].” |  |

How ChatGPT can support fundamental analysis

ChatGPT can be a valuable tool for conducting fundamental analysis by offering insights into key financial metrics, analysing sector performance, and identifying broader market trends. By providing a quick overview of a company’s financial health, competitive positioning, and industry dynamics, it can your boost your decision making.

Here are some ways ChatGPT can assist with fundamental analysis:

- Summarising key financial metrics: ChatGPT can quickly summarise financial reports and offer insights on key metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, revenue growth, debt levels, and profit margins. This allows you to understand a company’s valuation, growth prospects, and financial stability at a glance.

- Analysing sector and industry performance: By keeping track of trends in different sectors, ChatGPT can highlight which industries are currently performing well and why. It can also provide insights into emerging sectors, such as technology, renewable energy, or healthcare, helping you spot opportunities in areas with high growth potential.

- Identifying market trends and key events: ChatGPT can track macroeconomic factors such as interest rates, inflation, and geopolitical events that may influence the market. It can also describe the current market sentiment, helping you understand whether broader trends favour bullish or bearish conditions.

- Peer comparisons: It can help compare a company’s financial performance to its peers within the same industry. This can be helpful in determining whether a stock is undervalued or overvalued relative to competitors.

Key prompts to consider and sample responses

Here are three prompts to consider when conducting fundamental analysis and the type of output ChatGPT can provide:

| “What is the top-performing sector in the current market?” |  |

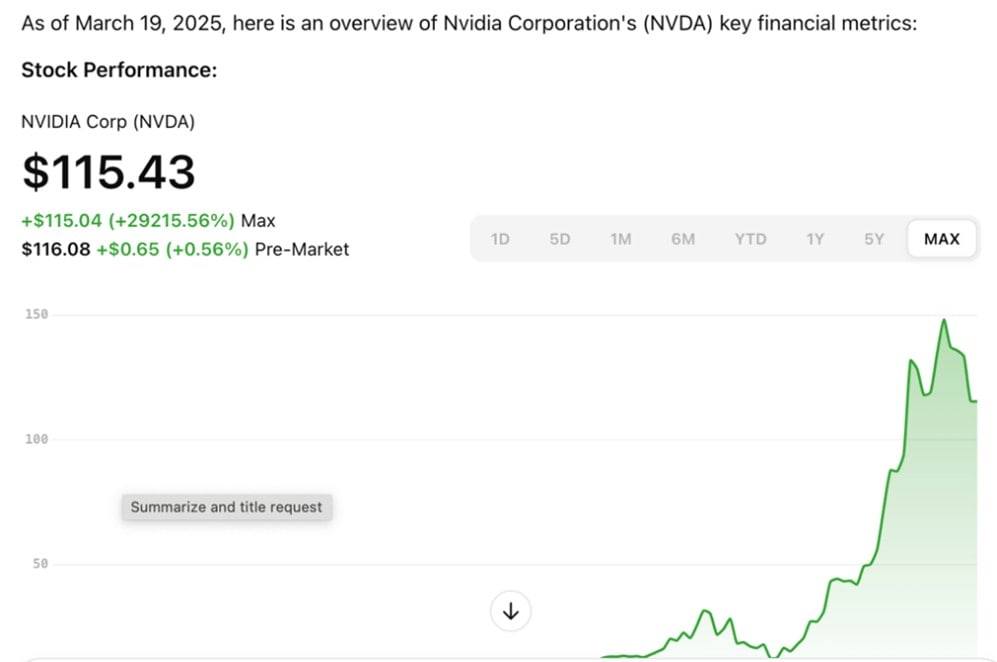

| “List high-growth tech stocks based on recent trends.” |  |

| “Summarise key financial metrics for [stock name].” |  |

To develop deeper insights, you can refine and expand your prompts based on specific objectives. For example, to identify top-performing sectors, you can follow up with questions about emerging trends or risks within that sector. When listing high-growth stocks, you could request more detailed criteria such as revenue growth, innovation, or competitive positioning. Similarly, after summarising key financial metrics for a stock, you can ask for a comparison with its competitors or deeper analysis of its financial health to better gauge its future potential.

Criteria for stock selection

Choosing the right stocks is a crucial step in developing a strong trading base. Successful stock selection involves analysing several factors, including growth potential, valuation, competitive positioning, and industry trends. ChatGPT can assist by quickly gathering relevant data, summarising key financial metrics, and highlighting potential risks. Following these steps ensures an informed and well-rounded trading decision process:

Key factors to consider in stock selection

1. Growth potential

What to look for:

- Consistent revenue growth

- Expanding market share

- Increasing profitability

Action steps:

- Analyse earnings reports and historical growth trends

- Identify companies with innovative products or expansion strategies

ChatGPT insight:

- Get a summary of past growth and future potential

Example prompt:

“What are the revenue and profit growth trends for [company name] over the last 5 years?”

Why it matters:

- Helps you spot businesses consistently outperforming the market

2. Valuation analysis

What to look for:

- Is the stock overvalued or undervalued?

Action steps:

- Examine key metrics (P/E ratio, P/B ratio, DCF analysis)

- Compare valuation with industry peers

ChatGPT insight:

- Get instant valuation comparisons to identify fair pricing

Example prompt:

“Compare the valuation metrics of [stock name] with its industry average.”

Why it matters:

- Ensures smarter buy/sell decisions based on fair value

3. Industry & sector trends

What to look for:

- High-growth sectors (AI, biotech, renewable energy)

- Market cycles and disruptive trends

Action steps:

- Track emerging opportunities before they go mainstream

ChatGPT insight:

- Stay updated on industry outlook and future potential

Example prompt:

“What are the biggest opportunities and challenges facing the [industry name] sector?”

Why it matters:

- Helps focus on industries with the highest growth potential

4. Competitive positioning

What to look for:

- Market share dominance

- Pricing power and innovation

Action steps:

- Compare financial strength, product differentiation, and growth strategies

ChatGPT insight:

- Get side-by-side competitor comparisons

Example prompt:

“How does [company name] compare to [competitor name] in terms of revenue growth and profit margins?”

Why it matters:

- Determines a company’s ability to sustain or grow its market position

5. Risk factors

What to look for:

- Economic downturns, regulatory changes, competition, or management issues

Action steps:

- Review financial statements for red flags (e.g., lawsuits, declining revenue)

ChatGPT insight:

- Scan financial reports and news for potential risks

Example prompt:

“What are the biggest risks associated with investing in [stock/industry]?”

Why it matters:

- Helps you make informed decisions and manage risk effectively

6. Analyst & market sentiment

What to look for:

- Analyst ratings and earnings call insights

- Social media sentiment and investor perception

Action steps:

- Use expert opinions to confirm or challenge your investment thesis

ChatGPT insight:

- Get a summary of the latest analyst recommendations

Example prompt:

“Summarise the latest analyst recommendations for [stock name].”

Why it matters:

- Market sentiment can provide early signals on stock performance

Developing trading strategies with ChatGPT

ChatGPT can help develop, refine, and optimise your trading strategies. It can generate ideas, assist with coding and backtesting, and offer fresh perspectives on market behaviour to create more effective, adaptable strategies:

Steps to develop a trading strategy

- Define the strategy type: Decide on the type of strategy (e.g., swing trading, day trading, trend following).

- Identify key market indicators: Use ChatGPT to suggest relevant technical indicators or fundamental factors for your strategy (e.g., moving averages, RSI, MACD).

- Develop the strategy framework: ChatGPT can help build the overall framework, such as entry and exit rules, risk management, and trade size.

- Code the strategy: ChatGPT can assist with writing the code for the strategy in languages like Python, including backtesting frameworks.

- Backtest the strategy: Automate the backtesting process with ChatGPT, testing the strategy across historical data to assess its performance.

- Refine and optimise: Based on backtesting results, use ChatGPT to suggest optimisations, such as adjusting risk parameters or adding new indicators.

Key prompts to consider:

- “Generate a swing trading strategy for the S&P 500 based on historical price trends.”

- “Provide a step-by-step guide to developing an algorithmic trading strategy for crypto markets.”

- “Write a Python script for backtesting a moving average crossover strategy.”

Conducting technical analysis with ChatGPT

You can use ChatGPT to interpret technical indicators, recognise chart patterns, and assess potential entry and exit points by leveraging its ability to explain complex concepts in an accessible way. By analysing indicators like moving averages, relative strength index (RSI), MACD, and Bollinger bands, ChatGPT can help you understand how to use these tools effectively in your strategies.

For a more thorough analysis, you can upload a screenshot of a TradingView chart into ChatGPT. By examining the chart, ChatGPT can help identify technical patterns, support and resistance levels, or trends that may not be immediately obvious. It can provide a detailed explanation of what is happening on the chart and offer insights into potential market movements. Additionally, ChatGPT can offer advice on combining multiple indicators to enhance accuracy, refine timing, and improve overall decision-making.

Key prompts and sample responses:

| “What is the latest news affecting [stock name]?” |  |

| “How has [company name] performed over the last five years?” |  |

| “Generate a risk-reward analysis for [stock name].” | ![Generate_a_risk-reward_analysis_for_[stock_name].”-min.jpg](https://eu-images.contentstack.com/v3/assets/bltaec35894448c7261/blt8f7b4a1901a43fe1/6847ce4f1f23e97d1fae46c6/Generate_a_risk-reward_analysis_for_[stock_name].%E2%80%9D-min.jpg) |

Risk management insights

Effective risk management can help you protect your capital, manage volatility, and enhance long-term profitability. ChatGPT can assist traders in calculating, understanding risk and devising stop-loss strategies tailored to different trading styles.

Key aspects of risk management:

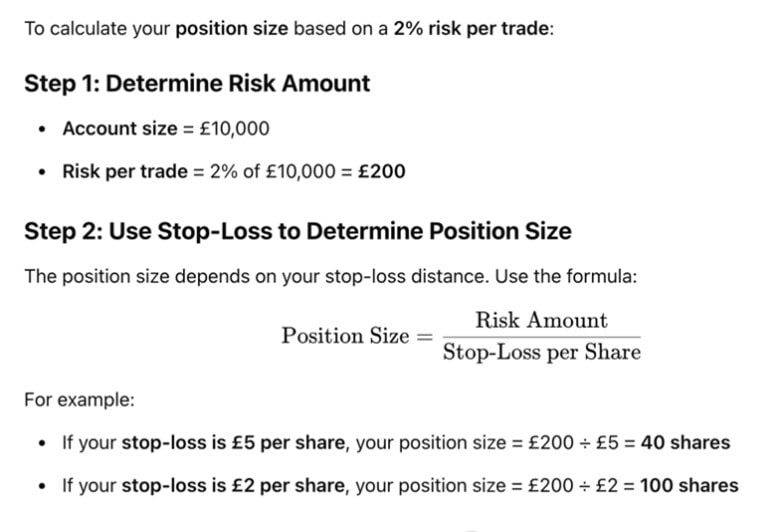

1. Position sizing: Determining the correct position size based on risk tolerance, account size, and trade setup is crucial. ChatGPT can provide formulas and guidelines to help traders avoid overexposure.

Key prompts and example calculation

| “If I have a £10,000 account and I risk 2% per trade, what should my position size be?” |  |

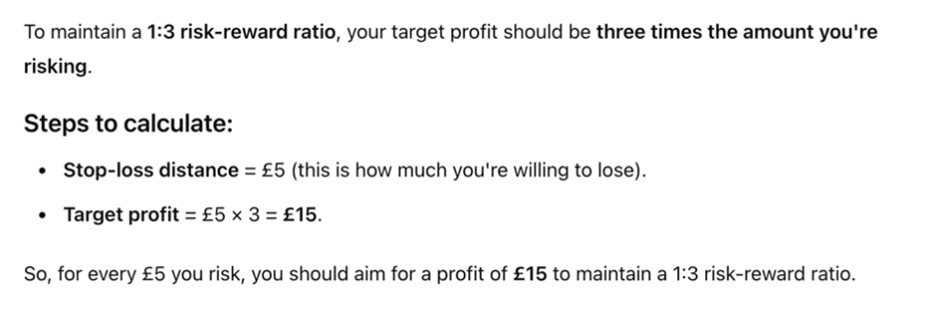

2. Risk-reward ratios: Understanding the relationship between risk and potential reward helps traders make informed decisions. ChatGPT can assist in setting appropriate ratios, such as 1:2 or 1:3, ensuring that potential profits outweigh potential losses.

| “If my stop-loss is £5 below the entry price, how much profit should I target to maintain a 1:3 risk-reward ratio?” |  |

3. Stop-loss and take-profit strategies: Implementing stop-loss orders prevents excessive losses, while take-profit orders lock in gains. ChatGPT can suggest strategies based on volatility, price action, and market conditions. Example Strategies:

- Fixed percentage stops (e.g., 2% of account balance)

- ATR-based stops (adjusting stops based on volatility)

- Trailing stops (locking in profits as the trade moves in your favour)

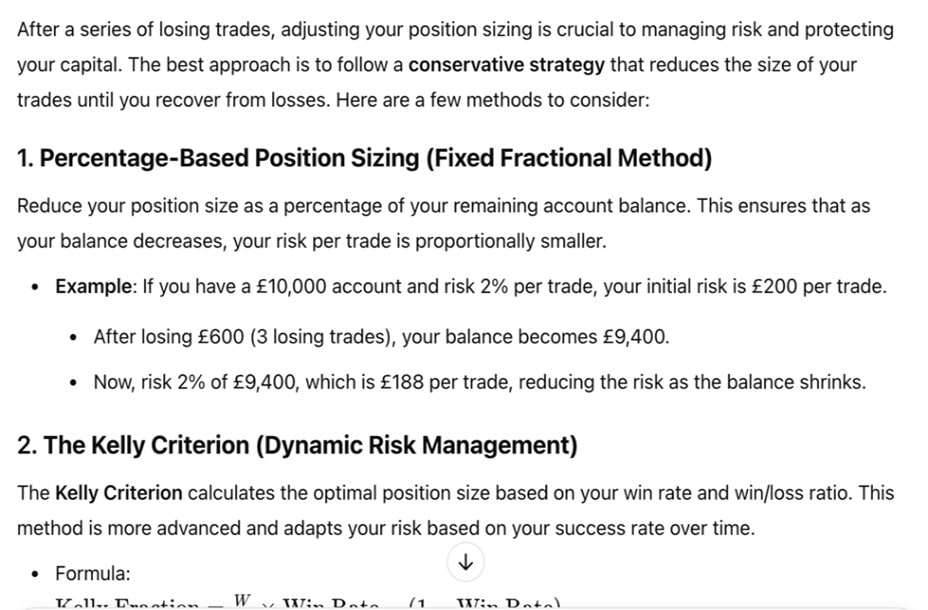

4. Drawdown management: A drawdown is the decline in an account from its peak value. Managing drawdowns is critical to maintaining long-term trading success. ChatGPT can help traders develop risk-control strategies to recover from losses efficiently.

| “What’s the best way to adjust my position sizing after a series of losing trades?” |  |

Other key risk management prompts:

- “How can I calculate position size based on my risk tolerance and account size?”

- “Explain the concept of drawdown and how traders can mitigate its impact.”

- “Suggest stop-loss and take-profit strategies for day trading.”

- “How can I use volatility to set more effective stop-loss levels?”

- “What’s the best risk-reward ratio for swing trading versus scalping?”

Using ChatGPT as a trading educational tool

ChatGPT can serve as a valuable educational resource for those aiming to deepen their understanding of trading concepts, market behaviour, and advanced strategies. By integrating AI-driven insights with expert analysis from Today Markets market analysis and structured learning from Learn to Trade, traders can develop a comprehensive approach to market analysis.

Key learning areas & example prompts

| Learning area | Example prompt | How ChatGPT can help |

| Trading strategies | “Explain the difference between scalping, day trading, and swing trading.” | Provides a structured breakdown of each strategy, including pros, cons, and best use cases. |

| Market drivers | “What are the key factors that influence commodity prices?” | Summarises supply-demand dynamics, geopolitical risks, and macroeconomic influences. |

| Trading psychology | “Describe the psychological biases that affect traders and how to overcome them.” | Identifies common biases (fear, greed, overconfidence) and suggests strategies to manage emotions while trading. |

Understanding ChatGPT’s limitations in trading

While ChatGPT is a powerful tool for generating insights, you should be aware of its limitations to ensure responsible and effective use. ChatGPT does not provide real-time market data or live price feeds, meaning its analysis is based on historical trends and publicly available information rather than current market conditions. Additionally, AI-generated insights may contain biases depending on the data sources and models used, making it essential for traders to verify recommendations before making trading decisions.

Best practices for responsible AI use in trading

- Cross-check AI-generated insights with live market data from platforms like TradingView, Pepperstone’s Smart Trader Tools, or Bloomberg.

- Ensure compliance with trading regulations by verifying AI-assisted strategies align with industry standards and risk management principles.

- Use ChatGPT as a supplementary tool, rather than relying on it exclusively, to maintain a well-rounded approach to market analysis.