The Bladerunner Trade

What you'll learn

Understand the core concept and logic behind the Bladerunner Trade

Learn how to use the 20 EMA as a dynamic support/resistance line

Identify valid Bladerunner setups using price action and candlestick confirmation

Know how to trade pullbacks and breakouts with precision

Learn how to place entries, stop-losses, and take-profits based on structure

Discover how to apply the strategy across Forex, crypto, or indices

Analyze real-world trade examples and learn how to avoid common mistakes

The London Hammer trading strategy

What you'll learn

Understand the Hammer candlestick pattern and its psychological meaning

Learn how to spot valid Hammer setups during the London session

Discover how to combine this pattern with support/resistance and session timing for high-probability trades

Learn how to place precise entries, stop-losses, and profit targets

Explore the best timeframes and currency pairs for this strategy

Analyze real-world examples of winning and losing trades to understand how to adapt in live markets

Trend and Continuation Patterns

What you'll learn

Understand what market trends are and how they behave

Identify uptrends, downtrends, and sideways/consolidation phases

Recognize key continuation patterns such as:

Flags and Pennants

Triangles (Ascending, Descending, Symmetrical)

Rectangles

Interpret volume behavior during pattern formation

Use these patterns to set entries, exits, and stop-loss levels

Combine trend patterns with other indicators for better accuracy

Understanding Moving Averages

What you'll learn

Understand the concept and purpose of moving averages

Differentiate between Simple Moving Averages (SMA) and Exponential Moving Averages (EMA)

Interpret how moving averages help identify trends and potential reversals

Use moving averages as dynamic support and resistance levels

Apply moving averages in combination with other indicators

Recognize common strategies, such as crossovers and trend-following systems

Technical analysis

What you'll learn

What You Will Learn

By the end of this section, students will:

Understand the fundamentals of technical analysis and why it works.

Learn how to read and interpret basic price charts.

Identify trends, support, and resistance levels.

Recognize simple technical patterns that signal possible market moves.

Gain an introduction to technical indicators used for confirmation.

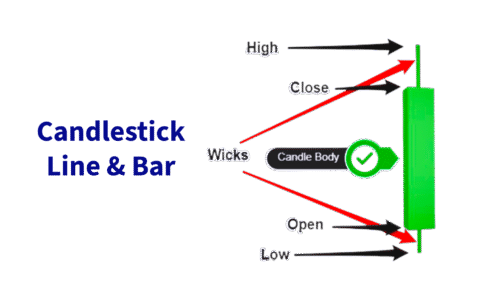

Chart Types: candlestick, line, bar

What you'll learn

Identify and distinguish between candlestick, line, and bar charts

Understand the structure and components of each chart type

Interpret key price information such as open, high, low, and close (OHLC)

Recognize the strengths and weaknesses of each chart type

Apply appropriate chart types to different trading and analysis scenarios

Gain confidence in using charts to support investment decisions

Five Candlestick Patterns

What you'll learn

The structure of candlesticks and how to interpret them

The 5 most important candlestick patterns and what they signal

How to identify bullish vs. bearish formations

Real-world chart examples of each pattern in action

How to incorporate candlestick patterns into your trading strategy

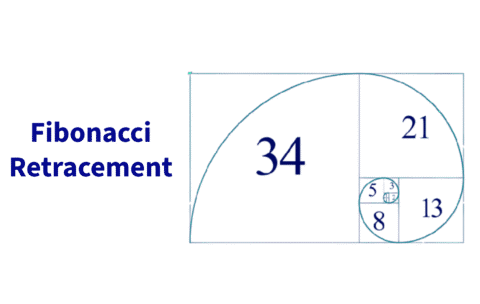

Trading with Fibonacci retracement

What you'll learn

The theory behind Fibonacci retracement and why it works in trading

How to correctly draw and interpret Fibonacci levels on price charts

Identifying confluence zones with Fibonacci and other indicators

Entry, stop-loss, and take-profit strategies using retracement levels

Common mistakes traders make when using Fibonacci — and how to avoid them

Trading Trendlines

What you'll learn

A trend line can indicate whether or not a trend is present. If a trend line has a positive slope, there is a positive association between the variables. If a trend line has a negative slope, there is a negative association between the variables.

Introduction to Fundamental Analysis

What you'll learn

Students will gain a strong foundation in understanding how economic, financial, and political factors drive asset prices. They will learn how to interpret financial statements, evaluate macroeconomic indicators, and connect global events to market movements. The course will also teach how to identify undervalued or overvalued assets, analyze company performance, and apply these insights to build long-term trading or investment strategies.

Introduction to Technical Analysis

What you'll learn

The fundamentals of technical analysis and why it’s used across financial markets.

How to read and interpret candlestick charts and price movements.

Key chart patterns such as head and shoulders, triangles, and flags.

How to identify support and resistance levels for smarter trade entries/exits.

The role of trendlines, moving averages, and momentum in market analysis.

Practical strategies to apply technical analysis in real-world trading scenarios.

Intro Trading Candles

What you'll learn

By the end of this section, students will:

Understand the structure of a candlestick (open, high, low, close).

Recognize the difference between bullish and bearish candles.

Identify common candlestick patterns that signal market sentiment.

Learn how to use candles to spot potential reversals and continuations.

Apply candlestick reading as a foundation for broader technical analysis.

Advanced technical analysis

What you'll learn

By the end of this section, students will:

Understand how to apply multi-timeframe analysis for stronger confirmations.

Learn how to use Fibonacci retracements and extensions to spot entry and target zones.

Recognize advanced chart patterns such as Head & Shoulders, Triangles, Flags, and Wedges.

Apply oscillators and momentum indicators (RSI, MACD, Stochastic) in advanced contexts.

Integrate multiple indicators and techniques into a cohesive trading strategy.

Fundamental Analysis

What you'll learn

By the end of this section, students will:

Understand the purpose of fundamental analysis and how it differs from technical analysis.

Learn how economic indicators (GDP, inflation, employment, interest rates) affect markets.

Explore how company earnings, balance sheets, and ratios are used in stock analysis.

Recognize the role of geopolitics and global events in shaping market sentiment.

Combine fundamentals with other tools to create a more complete trading picture.