Diversification as a market strategy

What you'll learn

Understand the principles and purpose of diversification

Learn about different types of diversification:

Asset class diversification (e.g., stocks, bonds, forex, crypto)

Sector and industry diversification

Geographic diversification

Strategy diversification (trend following, mean reversion, scalping, etc.)

Discover how diversification reduces portfolio volatility and drawdown

Learn how to measure and balance correlations between assets

Understand the risks of over-diversification and how to avoid them

Explore practical portfolio-building examples based on risk profile and goals

The London Hammer trading strategy

What you'll learn

Understand the Hammer candlestick pattern and its psychological meaning

Learn how to spot valid Hammer setups during the London session

Discover how to combine this pattern with support/resistance and session timing for high-probability trades

Learn how to place precise entries, stop-losses, and profit targets

Explore the best timeframes and currency pairs for this strategy

Analyze real-world examples of winning and losing trades to understand how to adapt in live markets

How to Trade DAX Futures

What you'll learn

What DAX futures are and how they differ from spot index trading

Key features of the DAX (Germany 40) and how it moves

How to trade DAX futures on platforms like Eurex or via CFDs

Strategies for day trading, swing trading, and hedging with DAX futures

How to manage risk, set stop-losses, and size positions properly

Trading the FTSE 100

What you'll learn

What the FTSE 100 Index is and what drives its price

Different ways to trade the FTSE 100 (spot, futures, CFDs, ETFs)

Key sectors and companies within the index and how they impact movement

Technical and fundamental analysis tools for FTSE 100 trading

Risk management techniques and trading strategies tailored to index trading

Trading the CAC 40 Index

What you'll learn

What the CAC 40 Index is and how it's structured

Key sectors and companies driving the index’s performance

How to trade the CAC 40 using CFDs, ETFs, and futures

Technical and fundamental strategies tailored to the French market

Risk management and timing tips for trading European indices

Trading the EU Stocks 50

What you'll learn

What the Euro Stoxx 50 Index is and how it is composed

How to trade the EU Stocks 50 using CFDs, futures, and ETFs

Economic and political factors that influence index volatility

Technical analysis strategies for trending and ranging conditions

Risk management techniques specific to index and European market trading

Trading the Russell 2000

What you'll learn

What the Russell 2000 Index is and how it’s constructed

Key factors that drive movements in small-cap stocks

How to trade the Russell 2000 using futures, CFDs, and ETFs (e.g., IWM)

Strategies for day trading, swing trading, and position trading the index

Risk management techniques for volatile small-cap environments

Dow Jones DJIA Futures

What you'll learn

What the Dow Jones (DJIA) Index is and how it is calculated

How Dow Jones futures work and where they are traded

Differences between E-mini and Micro Dow futures contracts

Technical and fundamental analysis methods for DJIA trading

Effective strategies for day trading and swing trading Dow futures

Trading the S&P 500 index

What you'll learn

What the S&P 500 Index is and how it's constructed

The different ways to trade the index (futures, CFDs, ETFs, options)

Key factors that influence S&P 500 price movements (economic data, earnings, Fed policy)

Technical and fundamental tools for analyzing S&P 500 setups

Risk management strategies tailored for index trading

Nasdaq 100 trading guide

What you'll learn

What the Nasdaq 100 is and how it differs from other indices

How to trade the Nasdaq 100 using spot, CFDs, ETFs, and futures

The economic and sector-specific drivers of Nasdaq 100 price movements

Technical and fundamental analysis tools for Nasdaq trading

Proven strategies for day trading, swing trading, and risk management

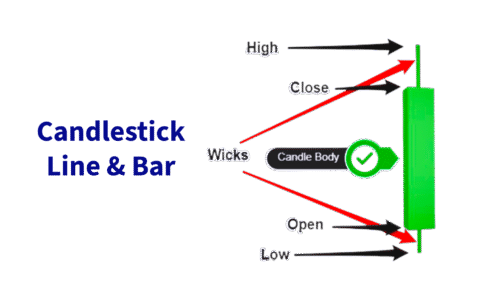

Chart Types: candlestick, line, bar

What you'll learn

Identify and distinguish between candlestick, line, and bar charts

Understand the structure and components of each chart type

Interpret key price information such as open, high, low, and close (OHLC)

Recognize the strengths and weaknesses of each chart type

Apply appropriate chart types to different trading and analysis scenarios

Gain confidence in using charts to support investment decisions

Five Candlestick Patterns

What you'll learn

The structure of candlesticks and how to interpret them

The 5 most important candlestick patterns and what they signal

How to identify bullish vs. bearish formations

Real-world chart examples of each pattern in action

How to incorporate candlestick patterns into your trading strategy

Introduction to Futures

What you'll learn

This course is designed for you. Dive into the basics of futures contracts, how contracts trade on a futures exchange, the different ways customers use these instruments and the benefits that futures provide.

Trading Trendlines

What you'll learn

A trend line can indicate whether or not a trend is present. If a trend line has a positive slope, there is a positive association between the variables. If a trend line has a negative slope, there is a negative association between the variables.

Intro Trading Candles

What you'll learn

By the end of this section, students will:

Understand the structure of a candlestick (open, high, low, close).

Recognize the difference between bullish and bearish candles.

Identify common candlestick patterns that signal market sentiment.

Learn how to use candles to spot potential reversals and continuations.

Apply candlestick reading as a foundation for broader technical analysis.