Expert Advisors (EAs)

What you'll learn

Understand what Expert Advisors (EAs) are and how they function within MetaTrader platforms

Learn the difference between fully automated and semi-automated trading systems

Discover how to install, configure, and test EAs on MT4/MT5

Explore the basics of backtesting and optimizing EAs using historical data

Understand key concepts like:

Risk parameters

Drawdown limits

Trade filters and time controls

Learn how to evaluate third-party EAs before using them in a live account

Gain awareness of the risks and limitations of automated trading

The London Hammer trading strategy

What you'll learn

Understand the Hammer candlestick pattern and its psychological meaning

Learn how to spot valid Hammer setups during the London session

Discover how to combine this pattern with support/resistance and session timing for high-probability trades

Learn how to place precise entries, stop-losses, and profit targets

Explore the best timeframes and currency pairs for this strategy

Analyze real-world examples of winning and losing trades to understand how to adapt in live markets

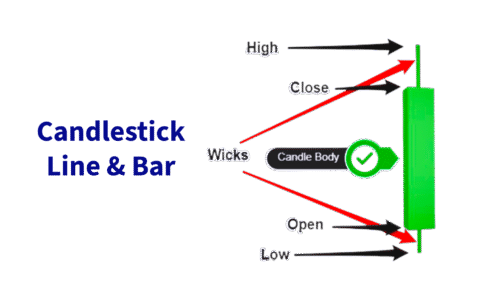

Chart Types: candlestick, line, bar

What you'll learn

Identify and distinguish between candlestick, line, and bar charts

Understand the structure and components of each chart type

Interpret key price information such as open, high, low, and close (OHLC)

Recognize the strengths and weaknesses of each chart type

Apply appropriate chart types to different trading and analysis scenarios

Gain confidence in using charts to support investment decisions

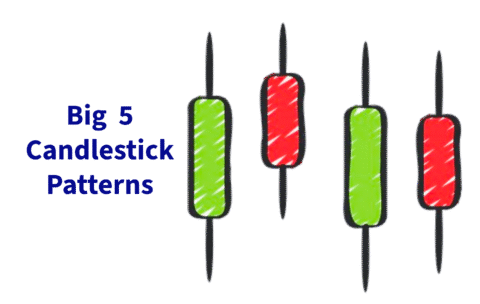

Five Candlestick Patterns

What you'll learn

The structure of candlesticks and how to interpret them

The 5 most important candlestick patterns and what they signal

How to identify bullish vs. bearish formations

Real-world chart examples of each pattern in action

How to incorporate candlestick patterns into your trading strategy

Trading with Fibonacci retracement

What you'll learn

The theory behind Fibonacci retracement and why it works in trading

How to correctly draw and interpret Fibonacci levels on price charts

Identifying confluence zones with Fibonacci and other indicators

Entry, stop-loss, and take-profit strategies using retracement levels

Common mistakes traders make when using Fibonacci — and how to avoid them

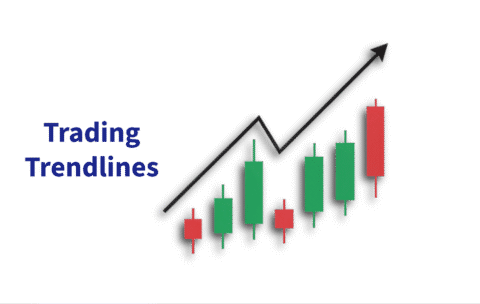

Trading Trendlines

What you'll learn

A trend line can indicate whether or not a trend is present. If a trend line has a positive slope, there is a positive association between the variables. If a trend line has a negative slope, there is a negative association between the variables.

Introduction to Technical Indicators

What you'll learn

Students will understand the role of technical indicators in analyzing market trends, momentum, and potential entry/exit points. They will learn how to apply popular indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. The course emphasizes not just using indicators in isolation, but combining them effectively to confirm signals and manage risk. By the end, students will be able to use technical indicators to support their trading strategies with greater confidence.

Intro Trading Candles

What you'll learn

By the end of this section, students will:

Understand the structure of a candlestick (open, high, low, close).

Recognize the difference between bullish and bearish candles.

Identify common candlestick patterns that signal market sentiment.

Learn how to use candles to spot potential reversals and continuations.

Apply candlestick reading as a foundation for broader technical analysis.