The London Hammer trading strategy

What you'll learn

Understand the Hammer candlestick pattern and its psychological meaning

Learn how to spot valid Hammer setups during the London session

Discover how to combine this pattern with support/resistance and session timing for high-probability trades

Learn how to place precise entries, stop-losses, and profit targets

Explore the best timeframes and currency pairs for this strategy

Analyze real-world examples of winning and losing trades to understand how to adapt in live markets

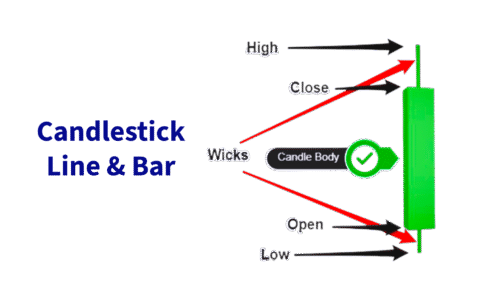

Chart Types: candlestick, line, bar

What you'll learn

Identify and distinguish between candlestick, line, and bar charts

Understand the structure and components of each chart type

Interpret key price information such as open, high, low, and close (OHLC)

Recognize the strengths and weaknesses of each chart type

Apply appropriate chart types to different trading and analysis scenarios

Gain confidence in using charts to support investment decisions

Exploring Exotic Forex Pairs

What you'll learn

What exotic forex pairs are and how they differ from major and minor pairs

Commonly traded exotic pairs (e.g., USD/TRY, EUR/ZAR, USD/SGD, USD/MXN)

Key drivers of price movements in exotic currencies (interest rates, political risk, capital flows)

How to manage the higher volatility and lower liquidity in exotic markets

Strategic approaches for trading exotics: news-based, carry trades, and long-term positioning

The major forex pairs

What you'll learn

What defines a major forex pair and why they matter in the market

Overview of each major pair: EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, NZD/USD, and USD/CAD

Key economic indicators and geopolitical factors that impact major pairs

Trading strategies tailored to each pair’s characteristics (volatility, session timing, etc.)

How to manage risk and capitalize on correlations between major pairs

What is EUR/USD

What you'll learn

What the EUR/USD currency pair represents and how it’s quoted

Key factors that influence its price: interest rates, inflation, and economic data

Popular strategies for trading EUR/USD (technical, fundamental, and news-based)

How to read EUR/USD charts and identify entry/exit points

Risk management techniques for forex trading

Introduction to Gapping in Trading

What you'll learn

What a price gap is and how gaps form on charts

The four main types of gaps: common, breakaway, runaway, and exhaustion gaps

How to interpret gaps as signals for momentum or reversals

Strategies for trading gap ups and gap downs

Risk management tips for trading in volatile, gapping conditions

What is Day Trading

What you'll learn

The definition of day trading and how it compares to other trading styles

The tools and platforms commonly used by day traders

Key strategies such as momentum trading, scalping, and breakout trading

Risk and money management principles to protect your capital

How to create a daily trading routine and trading plan

Five Candlestick Patterns

What you'll learn

The structure of candlesticks and how to interpret them

The 5 most important candlestick patterns and what they signal

How to identify bullish vs. bearish formations

Real-world chart examples of each pattern in action

How to incorporate candlestick patterns into your trading strategy

Trading Currency Pairs

What you'll learn

How the Forex market operates and the mechanics of currency pairs

Key concepts such as pips, lots, leverage, and margin

How to read Forex charts and use technical indicators for analysis

Fundamental factors that influence currency prices (e.g., interest rates, economic news)

Risk management strategies to protect your capital and minimize losses

Trading Trendlines

What you'll learn

A trend line can indicate whether or not a trend is present. If a trend line has a positive slope, there is a positive association between the variables. If a trend line has a negative slope, there is a negative association between the variables.

Intro Trading Candles

What you'll learn

By the end of this section, students will:

Understand the structure of a candlestick (open, high, low, close).

Recognize the difference between bullish and bearish candles.

Identify common candlestick patterns that signal market sentiment.

Learn how to use candles to spot potential reversals and continuations.

Apply candlestick reading as a foundation for broader technical analysis.