The London Hammer trading strategy

What you'll learn

Understand the Hammer candlestick pattern and its psychological meaning

Learn how to spot valid Hammer setups during the London session

Discover how to combine this pattern with support/resistance and session timing for high-probability trades

Learn how to place precise entries, stop-losses, and profit targets

Explore the best timeframes and currency pairs for this strategy

Analyze real-world examples of winning and losing trades to understand how to adapt in live markets

Fundamentals of Oil & Gas Hedging

What you'll learn

What hedging is and why it’s vital in the oil & gas industry

Key instruments used in hedging: futures, options, and swaps

How to structure basic hedging strategies for producers and consumers

Real-world examples of hedging crude oil, natural gas, and refined products

The risks and limitations of hedging in energy markets

Energy basis

What you'll learn

What energy basis means in crude oil, natural gas, and refined products markets

Key causes of basis risk: location, quality, transportation, and infrastructure constraints

How basis impacts producer revenue and hedging effectiveness

Hedging instruments used to manage basis risk, including basis swaps and spread trades

Real-world examples of basis hedging strategies and how they’re structured

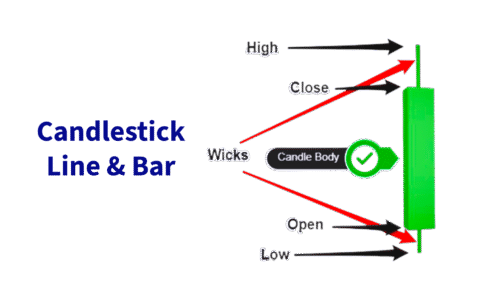

Chart Types: candlestick, line, bar

What you'll learn

Identify and distinguish between candlestick, line, and bar charts

Understand the structure and components of each chart type

Interpret key price information such as open, high, low, and close (OHLC)

Recognize the strengths and weaknesses of each chart type

Apply appropriate chart types to different trading and analysis scenarios

Gain confidence in using charts to support investment decisions

Oil & Gas Hedging with Swaps

What you'll learn

What commodity swaps are and how they differ from futures and options

How oil & gas companies use swaps to hedge price risk

Key components of a swap: fixed price, floating price, notional volume

Real-world examples of crude oil and natural gas swap strategies

Risks, benefits, and considerations when using swaps for hedging

Developing an Energy Hedging Policy

What you'll learn

Why an energy hedging policy is important for risk management

Key components of a comprehensive hedging policy

How to define risk exposure, hedging objectives, and risk tolerance

Governance, controls, and reporting structures for policy enforcement

Best practices for reviewing, updating, and communicating the policy internally

Forex Hedging

What you'll learn

The fundamentals of hedging and its role in the Forex market

Different types of hedging strategies (direct, cross, and options-based)

How to set up a hedge using Forex pairs, contracts, or options

Situations where hedging is beneficial — and when it’s not

How to manage and exit hedge positions effectively

Five Candlestick Patterns

What you'll learn

The structure of candlesticks and how to interpret them

The 5 most important candlestick patterns and what they signal

How to identify bullish vs. bearish formations

Real-world chart examples of each pattern in action

How to incorporate candlestick patterns into your trading strategy

Trading Trendlines

What you'll learn

A trend line can indicate whether or not a trend is present. If a trend line has a positive slope, there is a positive association between the variables. If a trend line has a negative slope, there is a negative association between the variables.

Intro Trading Candles

What you'll learn

By the end of this section, students will:

Understand the structure of a candlestick (open, high, low, close).

Recognize the difference between bullish and bearish candles.

Identify common candlestick patterns that signal market sentiment.

Learn how to use candles to spot potential reversals and continuations.

Apply candlestick reading as a foundation for broader technical analysis.