Expert Advisors (EAs)

What you'll learn

Understand what Expert Advisors (EAs) are and how they function within MetaTrader platforms

Learn the difference between fully automated and semi-automated trading systems

Discover how to install, configure, and test EAs on MT4/MT5

Explore the basics of backtesting and optimizing EAs using historical data

Understand key concepts like:

Risk parameters

Drawdown limits

Trade filters and time controls

Learn how to evaluate third-party EAs before using them in a live account

Gain awareness of the risks and limitations of automated trading

Advanced news trading strategies

What you'll learn

Master how to interpret high-impact economic news and assess its potential market reaction

Learn pre-news planning techniques, including entry setups and scenario mapping

Understand market psychology and price behavior during major news releases

Discover advanced strategies like:

Straddle entries

Spike and fade reversals

Post-news breakout confirmation trades

Learn how to avoid fakeouts and whipsaws using timing, filters, and sentiment tools

Apply precise risk management frameworks tailored to high-volatility trading

Analyze real-world trade examples from historical events

Macro trading

What you'll learn

Understand the core principles of macro trading and how it differs from technical trading

Learn how central bank policies, inflation, interest rates, and economic data affect markets

Discover how to analyze macro indicators such as GDP, CPI, PMI, and NFP reports

Explore how to trade macro themes through Forex, commodities, indices, and bonds

Gain insight into risk management and position sizing for longer-term, macro-based trades

Analyze historical case studies of successful macro trades and market shifts

Economic Indicators

What you'll learn

What economic indicators are and why they matter in financial markets

The difference between leading, lagging, and coincident indicators

Key indicators to watch (e.g., GDP, CPI, NFP, interest rates, PMI)

How economic data impacts currencies, stocks, bonds, and commodities

How to use economic calendars and plan around news releases

Trade the Non-Farm Payrolls

What you'll learn

What the NFP report is, how it's calculated, and why it moves markets

How to interpret NFP data alongside unemployment rate and average hourly earnings

Pre-release strategies: how to prepare using forecasts, sentiment, and positioning

Live trading strategies for high-volatility conditions (breakouts, fades, traps)

Post-release analysis and how to adjust your trading plan based on the results

Consumer Price Index

What you'll learn

What the Consumer Price Index (CPI) is and how it measures inflation

Why CPI is closely watched by central banks like the Federal Reserve and ECB

How CPI data impacts markets such as forex (USD pairs), gold, indices, and bonds

Pre-release analysis techniques, consensus expectations, and market positioning

Trading strategies for before, during, and after CPI announcements, including volatility setups

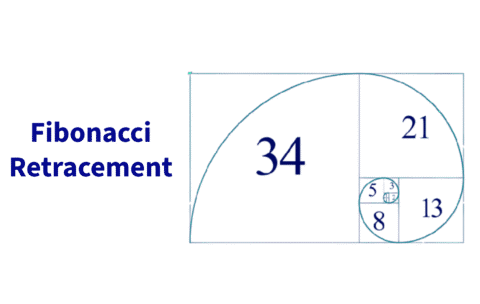

Trading with Fibonacci retracement

What you'll learn

The theory behind Fibonacci retracement and why it works in trading

How to correctly draw and interpret Fibonacci levels on price charts

Identifying confluence zones with Fibonacci and other indicators

Entry, stop-loss, and take-profit strategies using retracement levels

Common mistakes traders make when using Fibonacci — and how to avoid them

A Guide to Trading the FOMC

What you'll learn

What the FOMC is, how it functions, and why its meetings move markets

How interest rate decisions and monetary policy statements impact asset prices (e.g., USD, gold, indices)

How to interpret the dot plot, economic projections, and Fed Chair press conferences

Pre-FOMC preparation: analyzing consensus, sentiment, and market positioning

Real-time and post-announcement trading strategies, including breakout and fade setups

Introduction to Technical Indicators

What you'll learn

Students will understand the role of technical indicators in analyzing market trends, momentum, and potential entry/exit points. They will learn how to apply popular indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. The course emphasizes not just using indicators in isolation, but combining them effectively to confirm signals and manage risk. By the end, students will be able to use technical indicators to support their trading strategies with greater confidence.