Advanced news trading strategies

What you'll learn

Master how to interpret high-impact economic news and assess its potential market reaction

Learn pre-news planning techniques, including entry setups and scenario mapping

Understand market psychology and price behavior during major news releases

Discover advanced strategies like:

Straddle entries

Spike and fade reversals

Post-news breakout confirmation trades

Learn how to avoid fakeouts and whipsaws using timing, filters, and sentiment tools

Apply precise risk management frameworks tailored to high-volatility trading

Analyze real-world trade examples from historical events

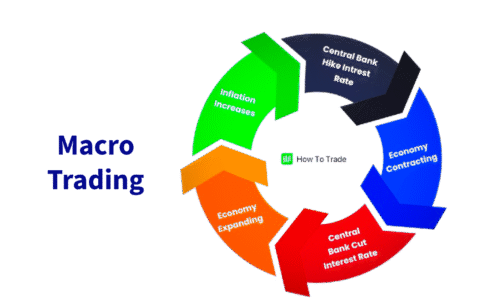

Macro trading

What you'll learn

Understand the core principles of macro trading and how it differs from technical trading

Learn how central bank policies, inflation, interest rates, and economic data affect markets

Discover how to analyze macro indicators such as GDP, CPI, PMI, and NFP reports

Explore how to trade macro themes through Forex, commodities, indices, and bonds

Gain insight into risk management and position sizing for longer-term, macro-based trades

Analyze historical case studies of successful macro trades and market shifts

Exploring Exotic Forex Pairs

What you'll learn

What exotic forex pairs are and how they differ from major and minor pairs

Commonly traded exotic pairs (e.g., USD/TRY, EUR/ZAR, USD/SGD, USD/MXN)

Key drivers of price movements in exotic currencies (interest rates, political risk, capital flows)

How to manage the higher volatility and lower liquidity in exotic markets

Strategic approaches for trading exotics: news-based, carry trades, and long-term positioning

The major forex pairs

What you'll learn

What defines a major forex pair and why they matter in the market

Overview of each major pair: EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, NZD/USD, and USD/CAD

Key economic indicators and geopolitical factors that impact major pairs

Trading strategies tailored to each pair’s characteristics (volatility, session timing, etc.)

How to manage risk and capitalize on correlations between major pairs

What is EUR/USD

What you'll learn

What the EUR/USD currency pair represents and how it’s quoted

Key factors that influence its price: interest rates, inflation, and economic data

Popular strategies for trading EUR/USD (technical, fundamental, and news-based)

How to read EUR/USD charts and identify entry/exit points

Risk management techniques for forex trading

Economic Indicators

What you'll learn

What economic indicators are and why they matter in financial markets

The difference between leading, lagging, and coincident indicators

Key indicators to watch (e.g., GDP, CPI, NFP, interest rates, PMI)

How economic data impacts currencies, stocks, bonds, and commodities

How to use economic calendars and plan around news releases

Introduction to Gapping in Trading

What you'll learn

What a price gap is and how gaps form on charts

The four main types of gaps: common, breakaway, runaway, and exhaustion gaps

How to interpret gaps as signals for momentum or reversals

Strategies for trading gap ups and gap downs

Risk management tips for trading in volatile, gapping conditions

What is Day Trading

What you'll learn

The definition of day trading and how it compares to other trading styles

The tools and platforms commonly used by day traders

Key strategies such as momentum trading, scalping, and breakout trading

Risk and money management principles to protect your capital

How to create a daily trading routine and trading plan

Trading Currency Pairs

What you'll learn

How the Forex market operates and the mechanics of currency pairs

Key concepts such as pips, lots, leverage, and margin

How to read Forex charts and use technical indicators for analysis

Fundamental factors that influence currency prices (e.g., interest rates, economic news)

Risk management strategies to protect your capital and minimize losses

Trade the Non-Farm Payrolls

What you'll learn

What the NFP report is, how it's calculated, and why it moves markets

How to interpret NFP data alongside unemployment rate and average hourly earnings

Pre-release strategies: how to prepare using forecasts, sentiment, and positioning

Live trading strategies for high-volatility conditions (breakouts, fades, traps)

Post-release analysis and how to adjust your trading plan based on the results

Consumer Price Index

What you'll learn

What the Consumer Price Index (CPI) is and how it measures inflation

Why CPI is closely watched by central banks like the Federal Reserve and ECB

How CPI data impacts markets such as forex (USD pairs), gold, indices, and bonds

Pre-release analysis techniques, consensus expectations, and market positioning

Trading strategies for before, during, and after CPI announcements, including volatility setups

A Guide to Trading the FOMC

What you'll learn

What the FOMC is, how it functions, and why its meetings move markets

How interest rate decisions and monetary policy statements impact asset prices (e.g., USD, gold, indices)

How to interpret the dot plot, economic projections, and Fed Chair press conferences

Pre-FOMC preparation: analyzing consensus, sentiment, and market positioning

Real-time and post-announcement trading strategies, including breakout and fade setups