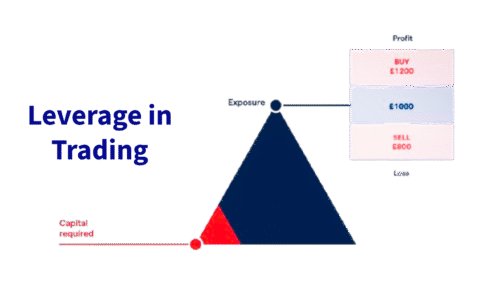

Leverage in Trading

What you'll learn

What leverage is and how it works in different markets

The relationship between leverage, margin, and position size

How to calculate leveraged trades and potential outcomes

Risks of over-leveraging and how to avoid common mistakes

How to use leverage responsibly within your trading strategy

Trading an IPO

What you'll learn

What an IPO is and how the IPO process works

How to analyze a company before it goes public

Key factors that influence IPO price movement

Trading strategies for IPO day and post-IPO opportunities

Risks and challenges unique to IPO trading

Most Traded Cryptocurrencies Globally

What you'll learn

Overview of the top traded cryptocurrencies by volume and market cap

The technology, use cases, and teams behind leading coins like Bitcoin, Ethereum, and others

How liquidity and volatility affect trading opportunities

Key metrics for analyzing and comparing different cryptocurrencies

How to build a diversified crypto trading or investment strategy

Economic Indicators

What you'll learn

What economic indicators are and why they matter in financial markets

The difference between leading, lagging, and coincident indicators

Key indicators to watch (e.g., GDP, CPI, NFP, interest rates, PMI)

How economic data impacts currencies, stocks, bonds, and commodities

How to use economic calendars and plan around news releases

Forex vs stocks

What you'll learn

Core differences between the Forex and stock markets

Pros and cons of trading currencies vs. individual stocks

Market structure, trading hours, and liquidity comparison

What influences price movements in each market

How to decide which market suits your trading personality and goals

What is Litecoin

What you'll learn

What Litecoin is, how it works, and its use cases

Key differences between Litecoin and other major cryptocurrencies

How to trade Litecoin on spot, margin, and CFD markets

Technical and fundamental tools for analyzing LTC price movements

Risk management strategies and trading tips specific to LTC

Crypto Trading

What you'll learn

In the Crypto Education Course, learners will discover the foundations of cryptocurrency trading and investing. The course explains how blockchain technology works, introduces major digital assets like Bitcoin and Ethereum, and demonstrates how crypto markets differ from traditional markets. Participants will learn how to open and manage a crypto trading account, understand market charts, use trading platforms, and practice risk management tailored to the volatility of crypto assets. By the end, beginners will have the knowledge to approach cryptocurrency trading with confidence and make informed decisions in this fast-growing sector.

Introduction to Bitcoin

What you'll learn

Transparency and reliability

Options on Bitcoin Friday futures are financially settled by reference to a fixing price, which, on the last business day of the week, shall correspond to the final settlement price for BFF. Options expiring prior to the last business day of the week shall correspond to a volume-weighted average price of transactions in BFF during the last sixty minutes of trading on the expiration date of the associated options contract (3:00:00 p.m. – 3:59:59 p.m. ET). This ensures transparency and reliability, providing traders with confidence in the settlement value of their contracts.

What is Ripple (XRP)?

What you'll learn

What Ripple and XRP are, and how they differ

How the Ripple network facilitates cross-border payments

The role of XRP as a bridge currency in financial transactions

Key differences between XRP and other cryptocurrencies like Bitcoin or Ethereum

Regulatory considerations and the current state of Ripple in global markets

How to trade Ethereum

What you'll learn

The basics of Ethereum and how it differs from other cryptocurrencies

How to analyze Ethereum’s price using technical and fundamental tools

Different ways to trade Ethereum (spot, margin, futures, and options)

How to choose a trading platform and manage risk effectively

Practical trading strategies for trending, ranging, and volatile markets

What is Dogecoin

What you'll learn

What Dogecoin is, how it originated, and what drives its price

How Dogecoin differs from other major cryptocurrencies

The basics of CFD trading and how it applies to DOGE

Advantages and risks of trading Dogecoin CFDs vs. spot trading

How to use technical analysis, leverage, and stop-losses in CFD trades

Solana Trading For Beginners

What you'll learn

What Solana is and how it compares to other major blockchains

The basics of trading SOL on popular crypto exchanges

How to analyze SOL’s price using technical and fundamental indicators

How to place your first trade and manage risk effectively

Common beginner mistakes and how to avoid them

The VIX Volatility Index

What you'll learn

What the VIX is, how it’s calculated, and what it represents

How the VIX reacts to market movements and investor sentiment

Ways to trade the VIX: futures, options, ETFs (like VXX, UVXY), and CFDs

How to use the VIX to hedge against market downturns

Trading strategies based on volatility spikes and mean reversion

How to Start Trading Stocks

What you'll learn

The basics of how the stock market works

Key differences between trading and investing

How to open a brokerage account and place your first trade

Introduction to stock analysis: technical vs. fundamental

Essential tips for managing risk and protecting your capital

What are bonds

What you'll learn

What bonds are and how they function as investment instruments

The different types of bonds (government, corporate, municipal, etc.)

Key bond terms: coupon, maturity, yield, credit rating, and more

How interest rates affect bond prices and returns

The pros and cons of investing in bonds vs. other asset classes

Developing an Energy Hedging Policy

What you'll learn

Why an energy hedging policy is important for risk management

Key components of a comprehensive hedging policy

How to define risk exposure, hedging objectives, and risk tolerance

Governance, controls, and reporting structures for policy enforcement

Best practices for reviewing, updating, and communicating the policy internally

Oil & Gas Hedging with Swaps

What you'll learn

What commodity swaps are and how they differ from futures and options

How oil & gas companies use swaps to hedge price risk

Key components of a swap: fixed price, floating price, notional volume

Real-world examples of crude oil and natural gas swap strategies

Risks, benefits, and considerations when using swaps for hedging

Trading Tips

What you'll learn

Practical tips for improving trade entries and exits

How to manage risk and protect your capital

Common mistakes most traders make — and how to avoid them

Psychological tips for staying disciplined and focused

Tools and routines that support long-term trading success

What is EUR/USD

What you'll learn

What the EUR/USD currency pair represents and how it’s quoted

Key factors that influence its price: interest rates, inflation, and economic data

Popular strategies for trading EUR/USD (technical, fundamental, and news-based)

How to read EUR/USD charts and identify entry/exit points

Risk management techniques for forex trading

The major forex pairs

What you'll learn

What defines a major forex pair and why they matter in the market

Overview of each major pair: EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, NZD/USD, and USD/CAD

Key economic indicators and geopolitical factors that impact major pairs

Trading strategies tailored to each pair’s characteristics (volatility, session timing, etc.)

How to manage risk and capitalize on correlations between major pairs

Exploring Exotic Forex Pairs

What you'll learn

What exotic forex pairs are and how they differ from major and minor pairs

Commonly traded exotic pairs (e.g., USD/TRY, EUR/ZAR, USD/SGD, USD/MXN)

Key drivers of price movements in exotic currencies (interest rates, political risk, capital flows)

How to manage the higher volatility and lower liquidity in exotic markets

Strategic approaches for trading exotics: news-based, carry trades, and long-term positioning

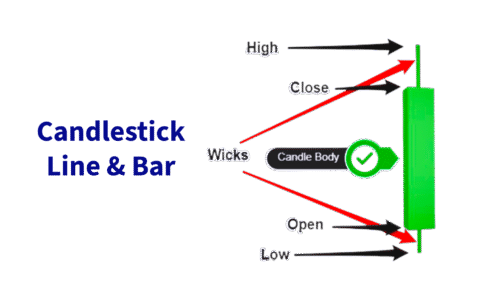

Chart Types: candlestick, line, bar

What you'll learn

Identify and distinguish between candlestick, line, and bar charts

Understand the structure and components of each chart type

Interpret key price information such as open, high, low, and close (OHLC)

Recognize the strengths and weaknesses of each chart type

Apply appropriate chart types to different trading and analysis scenarios

Gain confidence in using charts to support investment decisions

Understanding Moving Averages

What you'll learn

Understand the concept and purpose of moving averages

Differentiate between Simple Moving Averages (SMA) and Exponential Moving Averages (EMA)

Interpret how moving averages help identify trends and potential reversals

Use moving averages as dynamic support and resistance levels

Apply moving averages in combination with other indicators

Recognize common strategies, such as crossovers and trend-following systems

Trend and Continuation Patterns

What you'll learn

Understand what market trends are and how they behave

Identify uptrends, downtrends, and sideways/consolidation phases

Recognize key continuation patterns such as:

Flags and Pennants

Triangles (Ascending, Descending, Symmetrical)

Rectangles

Interpret volume behavior during pattern formation

Use these patterns to set entries, exits, and stop-loss levels

Combine trend patterns with other indicators for better accuracy

Energy basis

What you'll learn

What energy basis means in crude oil, natural gas, and refined products markets

Key causes of basis risk: location, quality, transportation, and infrastructure constraints

How basis impacts producer revenue and hedging effectiveness

Hedging instruments used to manage basis risk, including basis swaps and spread trades

Real-world examples of basis hedging strategies and how they’re structured

Fundamentals of Oil & Gas Hedging

What you'll learn

What hedging is and why it’s vital in the oil & gas industry

Key instruments used in hedging: futures, options, and swaps

How to structure basic hedging strategies for producers and consumers

Real-world examples of hedging crude oil, natural gas, and refined products

The risks and limitations of hedging in energy markets

Forex Cashback Bonuses

What you'll learn

The fundamentals of forex cashback bonuses and how they work

The different types of rebate structures (per trade, per lot, etc.)

How to choose reliable cashback providers and brokers

The potential risks and benefits of using cashback bonuses

How to integrate cashback strategies into your overall trading plan

Nasdaq 100 trading guide

What you'll learn

What the Nasdaq 100 is and how it differs from other indices

How to trade the Nasdaq 100 using spot, CFDs, ETFs, and futures

The economic and sector-specific drivers of Nasdaq 100 price movements

Technical and fundamental analysis tools for Nasdaq trading

Proven strategies for day trading, swing trading, and risk management