Trading Currency Pairs

What you'll learn

How the Forex market operates and the mechanics of currency pairs

Key concepts such as pips, lots, leverage, and margin

How to read Forex charts and use technical indicators for analysis

Fundamental factors that influence currency prices (e.g., interest rates, economic news)

Risk management strategies to protect your capital and minimize losses

Five Candlestick Patterns

What you'll learn

The structure of candlesticks and how to interpret them

The 5 most important candlestick patterns and what they signal

How to identify bullish vs. bearish formations

Real-world chart examples of each pattern in action

How to incorporate candlestick patterns into your trading strategy

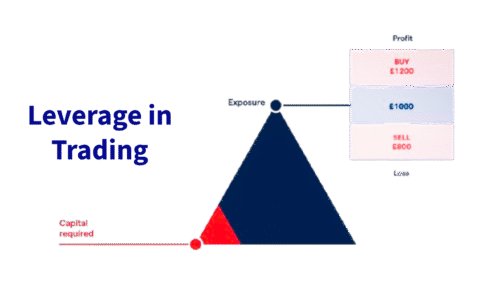

Leverage in Trading

What you'll learn

What leverage is and how it works in different markets

The relationship between leverage, margin, and position size

How to calculate leveraged trades and potential outcomes

Risks of over-leveraging and how to avoid common mistakes

How to use leverage responsibly within your trading strategy

Trading an IPO

What you'll learn

What an IPO is and how the IPO process works

How to analyze a company before it goes public

Key factors that influence IPO price movement

Trading strategies for IPO day and post-IPO opportunities

Risks and challenges unique to IPO trading

Swing Trading

What you'll learn

The fundamentals of swing trading and how it differs from day and long-term trading

How to identify trade setups using technical indicators and chart patterns

Entry and exit strategies based on support/resistance, trends, and momentum

Risk management techniques for protecting capital during volatile moves

How to develop and test a swing trading strategy that fits your style

Scalping in trading

What you'll learn

What scalping is and how it fits into the spectrum of trading styles

How to identify high-probability scalping setups using technical indicators

Tools and platforms best suited for fast execution

Risk and money management strategies to survive and thrive

How to build a repeatable, disciplined scalping routine

Most Traded Cryptocurrencies Globally

What you'll learn

Overview of the top traded cryptocurrencies by volume and market cap

The technology, use cases, and teams behind leading coins like Bitcoin, Ethereum, and others

How liquidity and volatility affect trading opportunities

Key metrics for analyzing and comparing different cryptocurrencies

How to build a diversified crypto trading or investment strategy

Trading Earnings Season

What you'll learn

What earnings season is and how it affects market behavior

How to interpret earnings reports, analyst expectations, and guidance

Trading strategies before, during, and after earnings announcements

Tools for finding upcoming earnings and tracking volatility

Risk management techniques specific to earnings-related trades

What is Day Trading

What you'll learn

The definition of day trading and how it compares to other trading styles

The tools and platforms commonly used by day traders

Key strategies such as momentum trading, scalping, and breakout trading

Risk and money management principles to protect your capital

How to create a daily trading routine and trading plan

Introduction to Gapping in Trading

What you'll learn

What a price gap is and how gaps form on charts

The four main types of gaps: common, breakaway, runaway, and exhaustion gaps

How to interpret gaps as signals for momentum or reversals

Strategies for trading gap ups and gap downs

Risk management tips for trading in volatile, gapping conditions

Bonds vs stocks

What you'll learn

The basic structure and purpose of both stocks and bonds

Key differences in risk, return, volatility, and income generation

How market conditions affect stocks and bonds differently

When to prioritize bonds vs. stocks in your portfolio

How to build a diversified strategy using both asset classes

Economic Indicators

What you'll learn

What economic indicators are and why they matter in financial markets

The difference between leading, lagging, and coincident indicators

Key indicators to watch (e.g., GDP, CPI, NFP, interest rates, PMI)

How economic data impacts currencies, stocks, bonds, and commodities

How to use economic calendars and plan around news releases

Forex Hedging

What you'll learn

The fundamentals of hedging and its role in the Forex market

Different types of hedging strategies (direct, cross, and options-based)

How to set up a hedge using Forex pairs, contracts, or options

Situations where hedging is beneficial — and when it’s not

How to manage and exit hedge positions effectively

Forex vs stocks

What you'll learn

Core differences between the Forex and stock markets

Pros and cons of trading currencies vs. individual stocks

Market structure, trading hours, and liquidity comparison

What influences price movements in each market

How to decide which market suits your trading personality and goals

CFDs vs ETFs

What you'll learn

The core differences between CFDs and ETFs

Advantages and disadvantages of each instrument

How leverage, ownership, and costs vary between the two

When to use CFDs vs. when ETFs might be a better choice

Real-world scenarios comparing CFD trades to ETF investments

What is Litecoin

What you'll learn

What Litecoin is, how it works, and its use cases

Key differences between Litecoin and other major cryptocurrencies

How to trade Litecoin on spot, margin, and CFD markets

Technical and fundamental tools for analyzing LTC price movements

Risk management strategies and trading tips specific to LTC

Crypto Trading

What you'll learn

In the Crypto Education Course, learners will discover the foundations of cryptocurrency trading and investing. The course explains how blockchain technology works, introduces major digital assets like Bitcoin and Ethereum, and demonstrates how crypto markets differ from traditional markets. Participants will learn how to open and manage a crypto trading account, understand market charts, use trading platforms, and practice risk management tailored to the volatility of crypto assets. By the end, beginners will have the knowledge to approach cryptocurrency trading with confidence and make informed decisions in this fast-growing sector.

Introduction to Bitcoin

What you'll learn

Transparency and reliability

Options on Bitcoin Friday futures are financially settled by reference to a fixing price, which, on the last business day of the week, shall correspond to the final settlement price for BFF. Options expiring prior to the last business day of the week shall correspond to a volume-weighted average price of transactions in BFF during the last sixty minutes of trading on the expiration date of the associated options contract (3:00:00 p.m. – 3:59:59 p.m. ET). This ensures transparency and reliability, providing traders with confidence in the settlement value of their contracts.

What is Ripple (XRP)?

What you'll learn

What Ripple and XRP are, and how they differ

How the Ripple network facilitates cross-border payments

The role of XRP as a bridge currency in financial transactions

Key differences between XRP and other cryptocurrencies like Bitcoin or Ethereum

Regulatory considerations and the current state of Ripple in global markets

How to trade Ethereum

What you'll learn

The basics of Ethereum and how it differs from other cryptocurrencies

How to analyze Ethereum’s price using technical and fundamental tools

Different ways to trade Ethereum (spot, margin, futures, and options)

How to choose a trading platform and manage risk effectively

Practical trading strategies for trending, ranging, and volatile markets

What is Dogecoin

What you'll learn

What Dogecoin is, how it originated, and what drives its price

How Dogecoin differs from other major cryptocurrencies

The basics of CFD trading and how it applies to DOGE

Advantages and risks of trading Dogecoin CFDs vs. spot trading

How to use technical analysis, leverage, and stop-losses in CFD trades

Solana Trading For Beginners

What you'll learn

What Solana is and how it compares to other major blockchains

The basics of trading SOL on popular crypto exchanges

How to analyze SOL’s price using technical and fundamental indicators

How to place your first trade and manage risk effectively

Common beginner mistakes and how to avoid them

The VIX Volatility Index

What you'll learn

What the VIX is, how it’s calculated, and what it represents

How the VIX reacts to market movements and investor sentiment

Ways to trade the VIX: futures, options, ETFs (like VXX, UVXY), and CFDs

How to use the VIX to hedge against market downturns

Trading strategies based on volatility spikes and mean reversion

How to Start Trading Stocks

What you'll learn

The basics of how the stock market works

Key differences between trading and investing

How to open a brokerage account and place your first trade

Introduction to stock analysis: technical vs. fundamental

Essential tips for managing risk and protecting your capital

What are bonds

What you'll learn

What bonds are and how they function as investment instruments

The different types of bonds (government, corporate, municipal, etc.)

Key bond terms: coupon, maturity, yield, credit rating, and more

How interest rates affect bond prices and returns

The pros and cons of investing in bonds vs. other asset classes

Developing an Energy Hedging Policy

What you'll learn

Why an energy hedging policy is important for risk management

Key components of a comprehensive hedging policy

How to define risk exposure, hedging objectives, and risk tolerance

Governance, controls, and reporting structures for policy enforcement

Best practices for reviewing, updating, and communicating the policy internally

Oil & Gas Hedging with Swaps

What you'll learn

What commodity swaps are and how they differ from futures and options

How oil & gas companies use swaps to hedge price risk

Key components of a swap: fixed price, floating price, notional volume

Real-world examples of crude oil and natural gas swap strategies

Risks, benefits, and considerations when using swaps for hedging

Trading Tips

What you'll learn

Practical tips for improving trade entries and exits

How to manage risk and protect your capital

Common mistakes most traders make — and how to avoid them

Psychological tips for staying disciplined and focused

Tools and routines that support long-term trading success