Diversification as a market strategy

What you'll learn

Understand the principles and purpose of diversification

Learn about different types of diversification:

Asset class diversification (e.g., stocks, bonds, forex, crypto)

Sector and industry diversification

Geographic diversification

Strategy diversification (trend following, mean reversion, scalping, etc.)

Discover how diversification reduces portfolio volatility and drawdown

Learn how to measure and balance correlations between assets

Understand the risks of over-diversification and how to avoid them

Explore practical portfolio-building examples based on risk profile and goals

Advanced news trading strategies

What you'll learn

Master how to interpret high-impact economic news and assess its potential market reaction

Learn pre-news planning techniques, including entry setups and scenario mapping

Understand market psychology and price behavior during major news releases

Discover advanced strategies like:

Straddle entries

Spike and fade reversals

Post-news breakout confirmation trades

Learn how to avoid fakeouts and whipsaws using timing, filters, and sentiment tools

Apply precise risk management frameworks tailored to high-volatility trading

Analyze real-world trade examples from historical events

Bolly Band Bounce trading strategy

What you'll learn

Understand how Bollinger Bands work and what they indicate about volatility and price behavior

Learn the core setup for the Bolly Band Bounce Strategy

Identify how to spot price rejection at the Bollinger Bands for entry opportunities

Master trade timing, stop-loss placement, and take-profit levels

Discover how to filter out false signals using trend direction, volume, or confirmation candles

Analyze real chart examples of the strategy in ranging and trending markets

Dual Stochastic Strategy

What you'll learn

Understand how the Stochastic Oscillator works and what it measures

Learn the logic and setup behind the Dual Stochastic Strategy

Discover how to combine fast and slow stochastic signals to find high-probability entries

Identify optimal conditions for using this strategy in trending and ranging markets

Get clear guidance on entry points, exit rules, stop-loss placement, and risk management

See real chart examples showing strategy performance in different market conditions

What is the Pop ‘n’ Stop trading strategy?

What you'll learn

Understand the core concept of the Pop ‘n’ Stop strategy

Learn how to identify potential breakout setups before they happen

Discover how to set entry points, stop-losses, and profit targets

Master the use of key tools like support/resistance zones, volume spikes, and candlestick signals

Gain insight into how this strategy fits within high-volatility market conditions

See real chart examples of successful and failed Pop ‘n’ Stop trades

Trading Strategy Types

What you'll learn

Understand the main types of trading strategies, including:

Scalping

Day Trading

Swing Trading

Position Trading

Learn how each strategy aligns with different timeframes, risk tolerance, and trading goals

Discover the pros and cons of each strategy type

Get practical insights into matching a trading style to your personality and lifestyle

Explore real-world examples and basic tools/indicators used in each strategy

Macro trading

What you'll learn

Understand the core principles of macro trading and how it differs from technical trading

Learn how central bank policies, inflation, interest rates, and economic data affect markets

Discover how to analyze macro indicators such as GDP, CPI, PMI, and NFP reports

Explore how to trade macro themes through Forex, commodities, indices, and bonds

Gain insight into risk management and position sizing for longer-term, macro-based trades

Analyze historical case studies of successful macro trades and market shifts

The Bladerunner Trade

What you'll learn

Understand the core concept and logic behind the Bladerunner Trade

Learn how to use the 20 EMA as a dynamic support/resistance line

Identify valid Bladerunner setups using price action and candlestick confirmation

Know how to trade pullbacks and breakouts with precision

Learn how to place entries, stop-losses, and take-profits based on structure

Discover how to apply the strategy across Forex, crypto, or indices

Analyze real-world trade examples and learn how to avoid common mistakes

Mastering stocks and indices

What you'll learn

By the end of this section, students will:

Understand index construction, weighting, and sector impacts on price movement.

Analyze stocks vs. indices using trend, momentum, volume, and market breadth.

Use ETFs and index futures to express directional and hedging views.

Incorporate earnings cycles, economic data, and volatility (e.g., VIX) into trade planning.

Build a rule-based strategy with position sizing, risk/reward, and post-trade review.

Pre-Market and After-Hours Trading

What you'll learn

The mechanics of pre-market and after-hours trading

Key benefits and risks associated with extended hours

How to access extended trading sessions through different brokers

Strategies for identifying trading opportunities outside regular hours

Best practices for managing risk during low-liquidity periods

Forex Cashback Bonuses

What you'll learn

The fundamentals of forex cashback bonuses and how they work

The different types of rebate structures (per trade, per lot, etc.)

How to choose reliable cashback providers and brokers

The potential risks and benefits of using cashback bonuses

How to integrate cashback strategies into your overall trading plan

Exploring Exotic Forex Pairs

What you'll learn

What exotic forex pairs are and how they differ from major and minor pairs

Commonly traded exotic pairs (e.g., USD/TRY, EUR/ZAR, USD/SGD, USD/MXN)

Key drivers of price movements in exotic currencies (interest rates, political risk, capital flows)

How to manage the higher volatility and lower liquidity in exotic markets

Strategic approaches for trading exotics: news-based, carry trades, and long-term positioning

The major forex pairs

What you'll learn

What defines a major forex pair and why they matter in the market

Overview of each major pair: EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, NZD/USD, and USD/CAD

Key economic indicators and geopolitical factors that impact major pairs

Trading strategies tailored to each pair’s characteristics (volatility, session timing, etc.)

How to manage risk and capitalize on correlations between major pairs

Trading Tips

What you'll learn

Practical tips for improving trade entries and exits

How to manage risk and protect your capital

Common mistakes most traders make — and how to avoid them

Psychological tips for staying disciplined and focused

Tools and routines that support long-term trading success

How to Start Trading Stocks

What you'll learn

The basics of how the stock market works

Key differences between trading and investing

How to open a brokerage account and place your first trade

Introduction to stock analysis: technical vs. fundamental

Essential tips for managing risk and protecting your capital

The VIX Volatility Index

What you'll learn

What the VIX is, how it’s calculated, and what it represents

How the VIX reacts to market movements and investor sentiment

Ways to trade the VIX: futures, options, ETFs (like VXX, UVXY), and CFDs

How to use the VIX to hedge against market downturns

Trading strategies based on volatility spikes and mean reversion

Forex vs stocks

What you'll learn

Core differences between the Forex and stock markets

Pros and cons of trading currencies vs. individual stocks

Market structure, trading hours, and liquidity comparison

What influences price movements in each market

How to decide which market suits your trading personality and goals

Bonds vs stocks

What you'll learn

The basic structure and purpose of both stocks and bonds

Key differences in risk, return, volatility, and income generation

How market conditions affect stocks and bonds differently

When to prioritize bonds vs. stocks in your portfolio

How to build a diversified strategy using both asset classes

Trading Earnings Season

What you'll learn

What earnings season is and how it affects market behavior

How to interpret earnings reports, analyst expectations, and guidance

Trading strategies before, during, and after earnings announcements

Tools for finding upcoming earnings and tracking volatility

Risk management techniques specific to earnings-related trades

Trading an IPO

What you'll learn

What an IPO is and how the IPO process works

How to analyze a company before it goes public

Key factors that influence IPO price movement

Trading strategies for IPO day and post-IPO opportunities

Risks and challenges unique to IPO trading

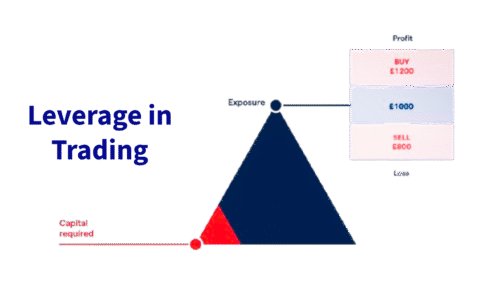

Leverage in Trading

What you'll learn

What leverage is and how it works in different markets

The relationship between leverage, margin, and position size

How to calculate leveraged trades and potential outcomes

Risks of over-leveraging and how to avoid common mistakes

How to use leverage responsibly within your trading strategy

Understanding Pips

What you'll learn

What a pip is and how it differs across currency pairs (standard, JPY pairs, etc.)

How to calculate pip value based on trade size and currency pair

How pip value affects profit, loss, and risk management in forex trades

The difference between pip value, tick size, and point value in other markets

How to use a pip value calculator and apply it to position sizing

FX Swap Trading

What you'll learn

The structure and mechanics of an FX swap: spot leg vs. forward leg

How interest rate differentials drive FX swap pricing and rollover costs

The difference between FX swaps, currency swaps, and forward contracts

How institutional traders and banks use FX swaps for hedging and arbitrage

Trading strategies that incorporate FX swaps, such as carry trade enhancements and synthetic positions

Micro FX futures

What you'll learn

In this educational webinar series, led by Director of Education David Gibbs, learn more about Micro FX futures ‒ smaller-sized contracts for expressing opinions on the changing value of major currencies against the US dollar.

Introduction to Trading Stocks

What you'll learn

Key Takeaways from the Trading Stocks Course

Understand Stock Market Basics – Learn what stocks are, how stock exchanges function, and the role of brokers and regulators.

Different Trading Styles – Explore approaches such as day trading, swing trading, and position trading, and identify which fits your goals.

Reading Charts & Indicators – Gain the ability to analyze stock charts, recognize patterns, and apply technical indicators for informed decisions.

Fundamental Analysis – Discover how to evaluate company performance using earnings, balance sheets, and market news.

Risk & Money Management – Learn essential strategies for managing risk, setting stop-losses, and protecting your trading capital.

Market Psychology – Understand trader behavior, emotions, and how market sentiment influences stock prices.

Building a Trading Plan – Create a structured, disciplined approach to trading that supports long-term growth.

Hands-on Learning – Apply knowledge through practice examples, simulated trades, and real market scenarios.