Expert Advisors (EAs)

What you'll learn

Understand what Expert Advisors (EAs) are and how they function within MetaTrader platforms

Learn the difference between fully automated and semi-automated trading systems

Discover how to install, configure, and test EAs on MT4/MT5

Explore the basics of backtesting and optimizing EAs using historical data

Understand key concepts like:

Risk parameters

Drawdown limits

Trade filters and time controls

Learn how to evaluate third-party EAs before using them in a live account

Gain awareness of the risks and limitations of automated trading

Mastering stocks and indices

What you'll learn

By the end of this section, students will:

Understand index construction, weighting, and sector impacts on price movement.

Analyze stocks vs. indices using trend, momentum, volume, and market breadth.

Use ETFs and index futures to express directional and hedging views.

Incorporate earnings cycles, economic data, and volatility (e.g., VIX) into trade planning.

Build a rule-based strategy with position sizing, risk/reward, and post-trade review.

Pre-Market and After-Hours Trading

What you'll learn

The mechanics of pre-market and after-hours trading

Key benefits and risks associated with extended hours

How to access extended trading sessions through different brokers

Strategies for identifying trading opportunities outside regular hours

Best practices for managing risk during low-liquidity periods

New Introduction to ETFs

What you'll learn

What ETFs are and how they differ from mutual funds and stocks

The different types of ETFs: index, sector, commodity, inverse, leveraged, and more

How ETF pricing works: NAV vs. market price and liquidity considerations

Strategies for using ETFs in investing and trading

Risks associated with ETFs and how to evaluate them effectively

Trading Tips

What you'll learn

Practical tips for improving trade entries and exits

How to manage risk and protect your capital

Common mistakes most traders make — and how to avoid them

Psychological tips for staying disciplined and focused

Tools and routines that support long-term trading success

How to Start Trading Stocks

What you'll learn

The basics of how the stock market works

Key differences between trading and investing

How to open a brokerage account and place your first trade

Introduction to stock analysis: technical vs. fundamental

Essential tips for managing risk and protecting your capital

Forex vs stocks

What you'll learn

Core differences between the Forex and stock markets

Pros and cons of trading currencies vs. individual stocks

Market structure, trading hours, and liquidity comparison

What influences price movements in each market

How to decide which market suits your trading personality and goals

Bonds vs stocks

What you'll learn

The basic structure and purpose of both stocks and bonds

Key differences in risk, return, volatility, and income generation

How market conditions affect stocks and bonds differently

When to prioritize bonds vs. stocks in your portfolio

How to build a diversified strategy using both asset classes

Introduction to Gapping in Trading

What you'll learn

What a price gap is and how gaps form on charts

The four main types of gaps: common, breakaway, runaway, and exhaustion gaps

How to interpret gaps as signals for momentum or reversals

Strategies for trading gap ups and gap downs

Risk management tips for trading in volatile, gapping conditions

What is Day Trading

What you'll learn

The definition of day trading and how it compares to other trading styles

The tools and platforms commonly used by day traders

Key strategies such as momentum trading, scalping, and breakout trading

Risk and money management principles to protect your capital

How to create a daily trading routine and trading plan

Trading Earnings Season

What you'll learn

What earnings season is and how it affects market behavior

How to interpret earnings reports, analyst expectations, and guidance

Trading strategies before, during, and after earnings announcements

Tools for finding upcoming earnings and tracking volatility

Risk management techniques specific to earnings-related trades

Scalping in trading

What you'll learn

What scalping is and how it fits into the spectrum of trading styles

How to identify high-probability scalping setups using technical indicators

Tools and platforms best suited for fast execution

Risk and money management strategies to survive and thrive

How to build a repeatable, disciplined scalping routine

Swing Trading

What you'll learn

The fundamentals of swing trading and how it differs from day and long-term trading

How to identify trade setups using technical indicators and chart patterns

Entry and exit strategies based on support/resistance, trends, and momentum

Risk management techniques for protecting capital during volatile moves

How to develop and test a swing trading strategy that fits your style

Trading an IPO

What you'll learn

What an IPO is and how the IPO process works

How to analyze a company before it goes public

Key factors that influence IPO price movement

Trading strategies for IPO day and post-IPO opportunities

Risks and challenges unique to IPO trading

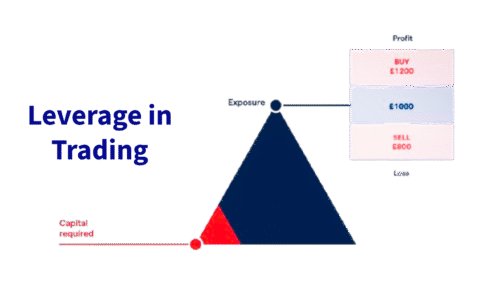

Leverage in Trading

What you'll learn

What leverage is and how it works in different markets

The relationship between leverage, margin, and position size

How to calculate leveraged trades and potential outcomes

Risks of over-leveraging and how to avoid common mistakes

How to use leverage responsibly within your trading strategy

Building a Trade Plan

What you'll learn

What is a trading plan?

A trading plan is a business plan for your trading career. Like any business plan, a trading plan is a working document in which you make assumptions about projected costs, revenues, and business conditions. Some of your assumptions may be right, some will surely be wrong. You wouldn't start a business without a business plan, so why would you start trading without a trading plan?

The real value in writing a trading plan is that it forces you to think about every part of your trading business, including confronting your strengths and weaknesses, and formulating reasonable expectations.

Any solid trading plan consists of the following five components. There are no shortcuts to developing a trading plan that will support your objectives. Take the time now to think about each of these components thoroughly and you will thank yourself later.

The Trade Plan

What you'll learn

Chapter 1 Expanding your Futures Knowledge: Use the trade plan to reinforce your knowledge of futures trading. Use pages 3-7 and page 13 to think about the futures products you are interested in and what information you need to know and record this information.

Chapter 2 Take your trade plan to the next level: In this section (pages 8-9), you will focus on yourself. Just as important as understanding the products, you must understand yourself, trading style and tolerance for risk. Understanding your tendencies will help guide your trading strategy.

Chapter 3 Practice what you’ve learned: This is where your learning is put into practice. Use our Trading Simulator to implement your own strategies and review their outcomes. Take notes and learn from your experiences. A template has been provided, but you may want to build your own spreadsheets to record your trading activity.

Master the trade

What you'll learn

Master the Trade: Futures is a course designed for new traders to increase their understanding of futures contracts and strategies for trading. This course brings together industry professionals so you can hear their perspectives on trading, learn about their strategies, and see how they approach various trading scenarios.

Intro to online trading

What you'll learn

With New to Markets, you’ll gain the essential knowledge and practical skills to begin your journey in online trading. You will learn how financial markets work, the differences between stocks, forex, and commodities, and how to analyze price movements using both technical and fundamental analysis.

Our program also introduces you to vital topics like risk management, trading psychology, and building a disciplined trading plan—the cornerstones of long-term success. By the end, you will understand how to navigate trading platforms confidently and apply proven strategies designed for beginners who want to grow into informed, independent traders.

Introduction to Trading Stocks

What you'll learn

Key Takeaways from the Trading Stocks Course

Understand Stock Market Basics – Learn what stocks are, how stock exchanges function, and the role of brokers and regulators.

Different Trading Styles – Explore approaches such as day trading, swing trading, and position trading, and identify which fits your goals.

Reading Charts & Indicators – Gain the ability to analyze stock charts, recognize patterns, and apply technical indicators for informed decisions.

Fundamental Analysis – Discover how to evaluate company performance using earnings, balance sheets, and market news.

Risk & Money Management – Learn essential strategies for managing risk, setting stop-losses, and protecting your trading capital.

Market Psychology – Understand trader behavior, emotions, and how market sentiment influences stock prices.

Building a Trading Plan – Create a structured, disciplined approach to trading that supports long-term growth.

Hands-on Learning – Apply knowledge through practice examples, simulated trades, and real market scenarios.

Introduction to Trading Styles

What you'll learn

In this section, students will explore the different trading styles that define how market participants approach decision-making and manage timeframes. You will learn the distinctions between scalping, day trading, swing trading, and position trading, and understand how each style requires unique levels of time commitment, risk management, and strategy. The course will also highlight the psychological and lifestyle factors that influence which trading style may be most suitable for you, helping you match your personal goals, temperament, and availability with an effective trading approach. By the end, you will be able to identify which style aligns with your objectives and how to adapt your techniques as market conditions change.

Introduction to Trading Strategies

What you'll learn

A student learning about trading strategies will gain insight into how traders approach the markets with discipline and structure. They will explore the differences between short-term and long-term strategies, such as scalping, day trading, swing trading, and position trading, and understand the advantages and risks of each. The course will teach how to combine technical indicators, chart patterns, and fundamental analysis to create strategies that fit different market conditions. Students will also learn about risk management, setting stop-loss and take-profit levels, and how to tailor a strategy to their personal goals, time commitment, and risk tolerance. By the end, they will understand how to build, test, and refine a strategy to trade consistently and with greater confidence.

The Traders Edge

What you'll learn

What You Will Learn

By the end of this course, students will:

Gain a clear understanding of Micro Bitcoin and Gold Futures, their contract specifications, and how to trade them effectively.

Develop risk management frameworks to protect capital and ensure longevity in trading.

Recognize and apply common trading patterns in Micro EUR/USD Futures to identify high-probability setups.

Learn how to combine technical patterns with volatility insights for smarter trade entries and exits.

Build a disciplined, structured approach to trading that focuses on consistency over short-term luck.

Advanced Trading Strategies

What you'll learn

By the end of this section, students will:

Explore multi-timeframe strategy integration for higher accuracy.

Apply volatility and momentum-based trading approaches.

Build confluence strategies using a mix of indicators, chart patterns, and price action.

Understand how to design rule-based systems for discipline and repeatability.

Learn to test, refine, and adapt strategies to different market conditions.