The London Hammer trading strategy

What you'll learn

Understand the Hammer candlestick pattern and its psychological meaning

Learn how to spot valid Hammer setups during the London session

Discover how to combine this pattern with support/resistance and session timing for high-probability trades

Learn how to place precise entries, stop-losses, and profit targets

Explore the best timeframes and currency pairs for this strategy

Analyze real-world examples of winning and losing trades to understand how to adapt in live markets

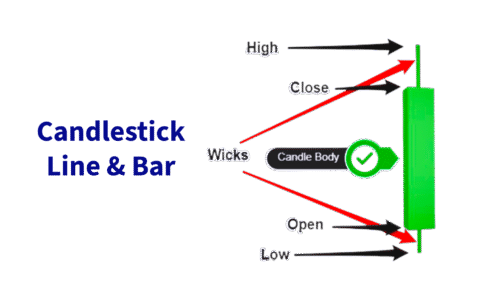

Chart Types: candlestick, line, bar

What you'll learn

Identify and distinguish between candlestick, line, and bar charts

Understand the structure and components of each chart type

Interpret key price information such as open, high, low, and close (OHLC)

Recognize the strengths and weaknesses of each chart type

Apply appropriate chart types to different trading and analysis scenarios

Gain confidence in using charts to support investment decisions

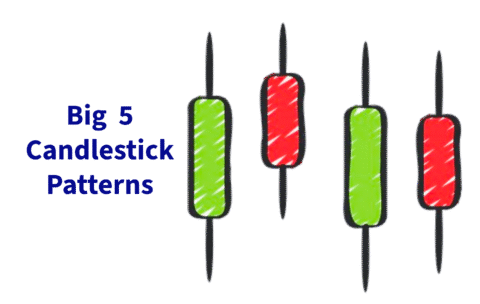

Five Candlestick Patterns

What you'll learn

The structure of candlesticks and how to interpret them

The 5 most important candlestick patterns and what they signal

How to identify bullish vs. bearish formations

Real-world chart examples of each pattern in action

How to incorporate candlestick patterns into your trading strategy

Cotton Futures

What you'll learn

The structure and specifications of cotton futures contracts, including tick size, contract size, and expiry

Key drivers of cotton prices, including global supply and demand, weather, and trade policies

How producers, manufacturers, and traders use cotton futures to hedge price risk

Techniques for applying technical and fundamental analysis to cotton markets

Trading strategies tailored to the volatility and seasonality of soft commodities like cotton

Cocoa Futures

What you'll learn

The fundamentals of cocoa futures contracts, including contract size, tick value, and delivery months

Key price drivers such as crop yields, political risk in producing countries, and global demand

How to use cocoa futures for hedging, speculation, or long-term investment strategies

Methods for conducting technical and fundamental analysis specific to soft commodities

Strategies for navigating the unique volatility and seasonality of cocoa markets

Coffee Futures

What you'll learn

The structure of coffee futures contracts (Arabica vs. Robusta), including lot size, tick value, and settlement

Key factors driving global coffee prices, such as weather, origin risk, and demand cycles

How commercial players (growers, roasters, importers) use coffee futures for hedging

How to apply technical and fundamental analysis to soft commodity markets

Effective trading strategies for volatile and seasonally-driven markets like coffee

Wheat Futures

What you'll learn

The basics of wheat futures contracts, including tick size, margin requirements, and contract expiration

Key market fundamentals affecting wheat prices: weather, harvest cycles, global supply, and trade flows

How producers and traders use wheat futures for hedging and price risk management

Techniques for analyzing wheat markets using both technical and fundamental tools

Practical trading strategies tailored to the unique characteristics of the wheat market

Soybean Futures

What you'll learn

The structure and mechanics of soybean futures contracts, including tick size, margin, and expiration

Major market drivers affecting soybean prices, such as weather, global trade, and crop reports

How to use soybean futures for hedging, risk management, and portfolio diversification

Techniques for technical and fundamental analysis specific to agricultural markets

Practical strategies for trading soybean futures, from short-term setups to long-term positioning

Corn Futures

What you'll learn

The fundamentals of corn futures and how they are traded on exchanges like CBOT

Key factors that influence corn prices, including supply, demand, weather, and global markets

How to read and interpret a corn futures contract (contract size, tick value, expiration dates)

Risk management strategies using corn futures, including hedging and stop-loss techniques

How to analyze market trends and apply technical and fundamental analysis in corn futures trading

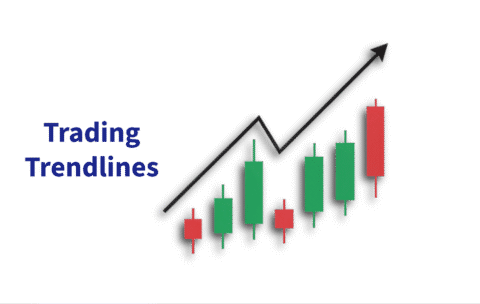

Trading Trendlines

What you'll learn

A trend line can indicate whether or not a trend is present. If a trend line has a positive slope, there is a positive association between the variables. If a trend line has a negative slope, there is a negative association between the variables.

Introduction to Grains and Oil-seeds

What you'll learn

Today’s agriculture markets are highly complex. Agricultural grain futures and options provide the tools the industry needs to manage risk and help put food on the table for a growing global population. Gain an understanding of the fundamentals that affect supply and demand in the grain and oilseed markets. Find out how futures and options provide critical price discovery and risk management roles for a variety of market participants, from farmers, ranchers, processors, distributors, wholesalers, retailers, traders and more. Discover the ways these contracts can fit into your portfolio.

Intro Trading Candles

What you'll learn

By the end of this section, students will:

Understand the structure of a candlestick (open, high, low, close).

Recognize the difference between bullish and bearish candles.

Identify common candlestick patterns that signal market sentiment.

Learn how to use candles to spot potential reversals and continuations.

Apply candlestick reading as a foundation for broader technical analysis.