Expert Advisors (EAs)

What you'll learn

Understand what Expert Advisors (EAs) are and how they function within MetaTrader platforms

Learn the difference between fully automated and semi-automated trading systems

Discover how to install, configure, and test EAs on MT4/MT5

Explore the basics of backtesting and optimizing EAs using historical data

Understand key concepts like:

Risk parameters

Drawdown limits

Trade filters and time controls

Learn how to evaluate third-party EAs before using them in a live account

Gain awareness of the risks and limitations of automated trading

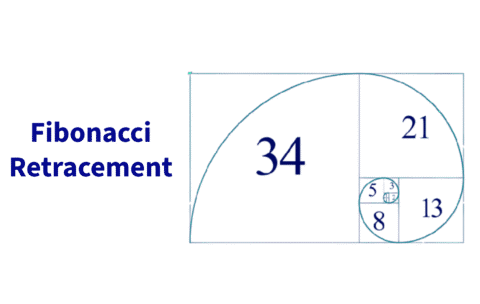

Trading with Fibonacci retracement

What you'll learn

The theory behind Fibonacci retracement and why it works in trading

How to correctly draw and interpret Fibonacci levels on price charts

Identifying confluence zones with Fibonacci and other indicators

Entry, stop-loss, and take-profit strategies using retracement levels

Common mistakes traders make when using Fibonacci — and how to avoid them

Cotton Futures

What you'll learn

The structure and specifications of cotton futures contracts, including tick size, contract size, and expiry

Key drivers of cotton prices, including global supply and demand, weather, and trade policies

How producers, manufacturers, and traders use cotton futures to hedge price risk

Techniques for applying technical and fundamental analysis to cotton markets

Trading strategies tailored to the volatility and seasonality of soft commodities like cotton

Cocoa Futures

What you'll learn

The fundamentals of cocoa futures contracts, including contract size, tick value, and delivery months

Key price drivers such as crop yields, political risk in producing countries, and global demand

How to use cocoa futures for hedging, speculation, or long-term investment strategies

Methods for conducting technical and fundamental analysis specific to soft commodities

Strategies for navigating the unique volatility and seasonality of cocoa markets

Coffee Futures

What you'll learn

The structure of coffee futures contracts (Arabica vs. Robusta), including lot size, tick value, and settlement

Key factors driving global coffee prices, such as weather, origin risk, and demand cycles

How commercial players (growers, roasters, importers) use coffee futures for hedging

How to apply technical and fundamental analysis to soft commodity markets

Effective trading strategies for volatile and seasonally-driven markets like coffee

Wheat Futures

What you'll learn

The basics of wheat futures contracts, including tick size, margin requirements, and contract expiration

Key market fundamentals affecting wheat prices: weather, harvest cycles, global supply, and trade flows

How producers and traders use wheat futures for hedging and price risk management

Techniques for analyzing wheat markets using both technical and fundamental tools

Practical trading strategies tailored to the unique characteristics of the wheat market

Soybean Futures

What you'll learn

The structure and mechanics of soybean futures contracts, including tick size, margin, and expiration

Major market drivers affecting soybean prices, such as weather, global trade, and crop reports

How to use soybean futures for hedging, risk management, and portfolio diversification

Techniques for technical and fundamental analysis specific to agricultural markets

Practical strategies for trading soybean futures, from short-term setups to long-term positioning

Corn Futures

What you'll learn

The fundamentals of corn futures and how they are traded on exchanges like CBOT

Key factors that influence corn prices, including supply, demand, weather, and global markets

How to read and interpret a corn futures contract (contract size, tick value, expiration dates)

Risk management strategies using corn futures, including hedging and stop-loss techniques

How to analyze market trends and apply technical and fundamental analysis in corn futures trading

Introduction to Grains and Oil-seeds

What you'll learn

Today’s agriculture markets are highly complex. Agricultural grain futures and options provide the tools the industry needs to manage risk and help put food on the table for a growing global population. Gain an understanding of the fundamentals that affect supply and demand in the grain and oilseed markets. Find out how futures and options provide critical price discovery and risk management roles for a variety of market participants, from farmers, ranchers, processors, distributors, wholesalers, retailers, traders and more. Discover the ways these contracts can fit into your portfolio.

Introduction to Technical Indicators

What you'll learn

Students will understand the role of technical indicators in analyzing market trends, momentum, and potential entry/exit points. They will learn how to apply popular indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. The course emphasizes not just using indicators in isolation, but combining them effectively to confirm signals and manage risk. By the end, students will be able to use technical indicators to support their trading strategies with greater confidence.