The VIX Volatility Index

What you'll learn

What the VIX is, how it’s calculated, and what it represents

How the VIX reacts to market movements and investor sentiment

Ways to trade the VIX: futures, options, ETFs (like VXX, UVXY), and CFDs

How to use the VIX to hedge against market downturns

Trading strategies based on volatility spikes and mean reversion

Solana Trading For Beginners

What you'll learn

What Solana is and how it compares to other major blockchains

The basics of trading SOL on popular crypto exchanges

How to analyze SOL’s price using technical and fundamental indicators

How to place your first trade and manage risk effectively

Common beginner mistakes and how to avoid them

What is Dogecoin

What you'll learn

What Dogecoin is, how it originated, and what drives its price

How Dogecoin differs from other major cryptocurrencies

The basics of CFD trading and how it applies to DOGE

Advantages and risks of trading Dogecoin CFDs vs. spot trading

How to use technical analysis, leverage, and stop-losses in CFD trades

How to trade Ethereum

What you'll learn

The basics of Ethereum and how it differs from other cryptocurrencies

How to analyze Ethereum’s price using technical and fundamental tools

Different ways to trade Ethereum (spot, margin, futures, and options)

How to choose a trading platform and manage risk effectively

Practical trading strategies for trending, ranging, and volatile markets

What is Ripple (XRP)?

What you'll learn

What Ripple and XRP are, and how they differ

How the Ripple network facilitates cross-border payments

The role of XRP as a bridge currency in financial transactions

Key differences between XRP and other cryptocurrencies like Bitcoin or Ethereum

Regulatory considerations and the current state of Ripple in global markets

Introduction to Bitcoin

What you'll learn

Transparency and reliability

Options on Bitcoin Friday futures are financially settled by reference to a fixing price, which, on the last business day of the week, shall correspond to the final settlement price for BFF. Options expiring prior to the last business day of the week shall correspond to a volume-weighted average price of transactions in BFF during the last sixty minutes of trading on the expiration date of the associated options contract (3:00:00 p.m. – 3:59:59 p.m. ET). This ensures transparency and reliability, providing traders with confidence in the settlement value of their contracts.

Crypto Trading

What you'll learn

In the Crypto Education Course, learners will discover the foundations of cryptocurrency trading and investing. The course explains how blockchain technology works, introduces major digital assets like Bitcoin and Ethereum, and demonstrates how crypto markets differ from traditional markets. Participants will learn how to open and manage a crypto trading account, understand market charts, use trading platforms, and practice risk management tailored to the volatility of crypto assets. By the end, beginners will have the knowledge to approach cryptocurrency trading with confidence and make informed decisions in this fast-growing sector.

What is Litecoin

What you'll learn

What Litecoin is, how it works, and its use cases

Key differences between Litecoin and other major cryptocurrencies

How to trade Litecoin on spot, margin, and CFD markets

Technical and fundamental tools for analyzing LTC price movements

Risk management strategies and trading tips specific to LTC

Forex vs stocks

What you'll learn

Core differences between the Forex and stock markets

Pros and cons of trading currencies vs. individual stocks

Market structure, trading hours, and liquidity comparison

What influences price movements in each market

How to decide which market suits your trading personality and goals

Economic Indicators

What you'll learn

What economic indicators are and why they matter in financial markets

The difference between leading, lagging, and coincident indicators

Key indicators to watch (e.g., GDP, CPI, NFP, interest rates, PMI)

How economic data impacts currencies, stocks, bonds, and commodities

How to use economic calendars and plan around news releases

Most Traded Cryptocurrencies Globally

What you'll learn

Overview of the top traded cryptocurrencies by volume and market cap

The technology, use cases, and teams behind leading coins like Bitcoin, Ethereum, and others

How liquidity and volatility affect trading opportunities

Key metrics for analyzing and comparing different cryptocurrencies

How to build a diversified crypto trading or investment strategy

Trading an IPO

What you'll learn

What an IPO is and how the IPO process works

How to analyze a company before it goes public

Key factors that influence IPO price movement

Trading strategies for IPO day and post-IPO opportunities

Risks and challenges unique to IPO trading

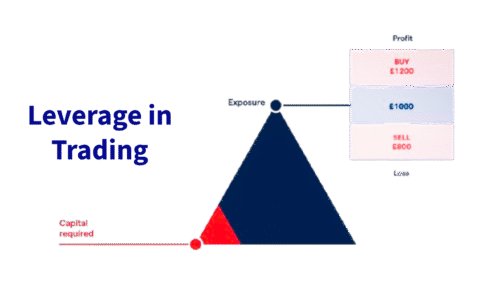

Leverage in Trading

What you'll learn

What leverage is and how it works in different markets

The relationship between leverage, margin, and position size

How to calculate leveraged trades and potential outcomes

Risks of over-leveraging and how to avoid common mistakes

How to use leverage responsibly within your trading strategy

Understanding Pips

What you'll learn

What a pip is and how it differs across currency pairs (standard, JPY pairs, etc.)

How to calculate pip value based on trade size and currency pair

How pip value affects profit, loss, and risk management in forex trades

The difference between pip value, tick size, and point value in other markets

How to use a pip value calculator and apply it to position sizing

Trade the Non-Farm Payrolls

What you'll learn

What the NFP report is, how it's calculated, and why it moves markets

How to interpret NFP data alongside unemployment rate and average hourly earnings

Pre-release strategies: how to prepare using forecasts, sentiment, and positioning

Live trading strategies for high-volatility conditions (breakouts, fades, traps)

Post-release analysis and how to adjust your trading plan based on the results

Consumer Price Index

What you'll learn

What the Consumer Price Index (CPI) is and how it measures inflation

Why CPI is closely watched by central banks like the Federal Reserve and ECB

How CPI data impacts markets such as forex (USD pairs), gold, indices, and bonds

Pre-release analysis techniques, consensus expectations, and market positioning

Trading strategies for before, during, and after CPI announcements, including volatility setups

Hang Seng Index

What you'll learn

The composition and structure of the Hang Seng Index and how it reflects the Hong Kong economy

Key economic, political, and sector-specific drivers of HSI price movements

How to analyze Hang Seng Index charts using technical indicators and price action

Trading strategies specific to the HSI, including momentum, breakout, and reversal setups

How to manage risk and position sizing when trading this highly volatile index

Cotton Futures

What you'll learn

The structure and specifications of cotton futures contracts, including tick size, contract size, and expiry

Key drivers of cotton prices, including global supply and demand, weather, and trade policies

How producers, manufacturers, and traders use cotton futures to hedge price risk

Techniques for applying technical and fundamental analysis to cotton markets

Trading strategies tailored to the volatility and seasonality of soft commodities like cotton

Cocoa Futures

What you'll learn

The fundamentals of cocoa futures contracts, including contract size, tick value, and delivery months

Key price drivers such as crop yields, political risk in producing countries, and global demand

How to use cocoa futures for hedging, speculation, or long-term investment strategies

Methods for conducting technical and fundamental analysis specific to soft commodities

Strategies for navigating the unique volatility and seasonality of cocoa markets

Coffee Futures

What you'll learn

The structure of coffee futures contracts (Arabica vs. Robusta), including lot size, tick value, and settlement

Key factors driving global coffee prices, such as weather, origin risk, and demand cycles

How commercial players (growers, roasters, importers) use coffee futures for hedging

How to apply technical and fundamental analysis to soft commodity markets

Effective trading strategies for volatile and seasonally-driven markets like coffee

Wheat Futures

What you'll learn

The basics of wheat futures contracts, including tick size, margin requirements, and contract expiration

Key market fundamentals affecting wheat prices: weather, harvest cycles, global supply, and trade flows

How producers and traders use wheat futures for hedging and price risk management

Techniques for analyzing wheat markets using both technical and fundamental tools

Practical trading strategies tailored to the unique characteristics of the wheat market

Soybean Futures

What you'll learn

The structure and mechanics of soybean futures contracts, including tick size, margin, and expiration

Major market drivers affecting soybean prices, such as weather, global trade, and crop reports

How to use soybean futures for hedging, risk management, and portfolio diversification

Techniques for technical and fundamental analysis specific to agricultural markets

Practical strategies for trading soybean futures, from short-term setups to long-term positioning

Corn Futures

What you'll learn

The fundamentals of corn futures and how they are traded on exchanges like CBOT

Key factors that influence corn prices, including supply, demand, weather, and global markets

How to read and interpret a corn futures contract (contract size, tick value, expiration dates)

Risk management strategies using corn futures, including hedging and stop-loss techniques

How to analyze market trends and apply technical and fundamental analysis in corn futures trading

What is xStation

What you'll learn

How to navigate the xStation platform and customize your trading workspace

How to place, manage, and close trades using different order types

How to analyze charts using technical indicators and drawing tools

How to use built-in tools like the trading calculator and risk management settings

How to access and apply real-time news, market sentiment, and heatmaps in your trading decisions

What is cTrader

What you'll learn

A student learning about cTrader will gain a comprehensive understanding of how to navigate and use the platform effectively for trading. They will learn how to place and manage trades, use advanced charting tools, customize layouts, and analyze market data. Additionally, they’ll explore automated trading with cAlgo, understand Level II pricing, and practice risk management using built-in tools. By the end of the course, students will be equipped to trade confidently and efficiently on cTrader.

Introduction to Futures

What you'll learn

This course is designed for you. Dive into the basics of futures contracts, how contracts trade on a futures exchange, the different ways customers use these instruments and the benefits that futures provide.

Introduction to Crude Oil

What you'll learn

Crude oil is a naturally occurring, non-renewable resource that's a fundamental component of the global economy. It's a raw material, often referred to as "black gold," that's refined into various petroleum products, including gasoline, jet fuel, and diesel. Understanding crude oil involves grasping its formation, extraction, refining, global trading, and the factors influencing its price.