Scalping in trading

What you'll learn

What scalping is and how it fits into the spectrum of trading styles

How to identify high-probability scalping setups using technical indicators

Tools and platforms best suited for fast execution

Risk and money management strategies to survive and thrive

How to build a repeatable, disciplined scalping routine

Swing Trading

What you'll learn

The fundamentals of swing trading and how it differs from day and long-term trading

How to identify trade setups using technical indicators and chart patterns

Entry and exit strategies based on support/resistance, trends, and momentum

Risk management techniques for protecting capital during volatile moves

How to develop and test a swing trading strategy that fits your style

Trading an IPO

What you'll learn

What an IPO is and how the IPO process works

How to analyze a company before it goes public

Key factors that influence IPO price movement

Trading strategies for IPO day and post-IPO opportunities

Risks and challenges unique to IPO trading

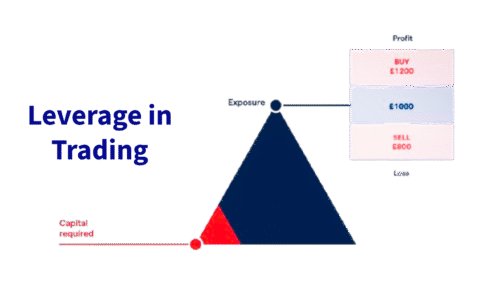

Leverage in Trading

What you'll learn

What leverage is and how it works in different markets

The relationship between leverage, margin, and position size

How to calculate leveraged trades and potential outcomes

Risks of over-leveraging and how to avoid common mistakes

How to use leverage responsibly within your trading strategy

Five Candlestick Patterns

What you'll learn

The structure of candlesticks and how to interpret them

The 5 most important candlestick patterns and what they signal

How to identify bullish vs. bearish formations

Real-world chart examples of each pattern in action

How to incorporate candlestick patterns into your trading strategy

Trading Currency Pairs

What you'll learn

How the Forex market operates and the mechanics of currency pairs

Key concepts such as pips, lots, leverage, and margin

How to read Forex charts and use technical indicators for analysis

Fundamental factors that influence currency prices (e.g., interest rates, economic news)

Risk management strategies to protect your capital and minimize losses

Understanding Pips

What you'll learn

What a pip is and how it differs across currency pairs (standard, JPY pairs, etc.)

How to calculate pip value based on trade size and currency pair

How pip value affects profit, loss, and risk management in forex trades

The difference between pip value, tick size, and point value in other markets

How to use a pip value calculator and apply it to position sizing

Trade the Non-Farm Payrolls

What you'll learn

What the NFP report is, how it's calculated, and why it moves markets

How to interpret NFP data alongside unemployment rate and average hourly earnings

Pre-release strategies: how to prepare using forecasts, sentiment, and positioning

Live trading strategies for high-volatility conditions (breakouts, fades, traps)

Post-release analysis and how to adjust your trading plan based on the results

Using ChatGPT in Trading

What you'll learn

How to use ChatGPT for market research, sentiment analysis, and trade idea generation

Techniques for using AI to summarize economic reports, earnings releases, and news events

How to prompt ChatGPT to write and explain trading strategies, indicators, and risk models

Using ChatGPT to assist with trading journal summaries and post-trade analysis

Intro to using ChatGPT with Python or trading platforms to support basic automation

Consumer Price Index

What you'll learn

What the Consumer Price Index (CPI) is and how it measures inflation

Why CPI is closely watched by central banks like the Federal Reserve and ECB

How CPI data impacts markets such as forex (USD pairs), gold, indices, and bonds

Pre-release analysis techniques, consensus expectations, and market positioning

Trading strategies for before, during, and after CPI announcements, including volatility setups

Automated Trading

What you'll learn

The core concepts of automated and algorithmic trading systems

How to build, backtest, and optimize automated strategies using trading platforms

The pros, cons, and risks of automated trading vs. manual trading

How to use programming tools (e.g., MQL4/5, cAlgo, Python APIs) to create custom bots

Key principles of strategy validation, risk management, and live deploymen

FX Swap Trading

What you'll learn

The structure and mechanics of an FX swap: spot leg vs. forward leg

How interest rate differentials drive FX swap pricing and rollover costs

The difference between FX swaps, currency swaps, and forward contracts

How institutional traders and banks use FX swaps for hedging and arbitrage

Trading strategies that incorporate FX swaps, such as carry trade enhancements and synthetic positions

Hang Seng Index

What you'll learn

The composition and structure of the Hang Seng Index and how it reflects the Hong Kong economy

Key economic, political, and sector-specific drivers of HSI price movements

How to analyze Hang Seng Index charts using technical indicators and price action

Trading strategies specific to the HSI, including momentum, breakout, and reversal setups

How to manage risk and position sizing when trading this highly volatile index

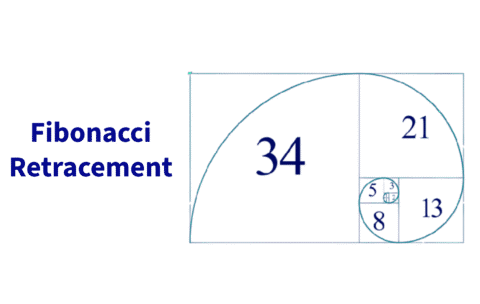

Trading with Fibonacci retracement

What you'll learn

The theory behind Fibonacci retracement and why it works in trading

How to correctly draw and interpret Fibonacci levels on price charts

Identifying confluence zones with Fibonacci and other indicators

Entry, stop-loss, and take-profit strategies using retracement levels

Common mistakes traders make when using Fibonacci — and how to avoid them

A Guide to Trading the FOMC

What you'll learn

What the FOMC is, how it functions, and why its meetings move markets

How interest rate decisions and monetary policy statements impact asset prices (e.g., USD, gold, indices)

How to interpret the dot plot, economic projections, and Fed Chair press conferences

Pre-FOMC preparation: analyzing consensus, sentiment, and market positioning

Real-time and post-announcement trading strategies, including breakout and fade setups

Building a Trade Plan

What you'll learn

What is a trading plan?

A trading plan is a business plan for your trading career. Like any business plan, a trading plan is a working document in which you make assumptions about projected costs, revenues, and business conditions. Some of your assumptions may be right, some will surely be wrong. You wouldn't start a business without a business plan, so why would you start trading without a trading plan?

The real value in writing a trading plan is that it forces you to think about every part of your trading business, including confronting your strengths and weaknesses, and formulating reasonable expectations.

Any solid trading plan consists of the following five components. There are no shortcuts to developing a trading plan that will support your objectives. Take the time now to think about each of these components thoroughly and you will thank yourself later.

The Trade Plan

What you'll learn

Chapter 1 Expanding your Futures Knowledge: Use the trade plan to reinforce your knowledge of futures trading. Use pages 3-7 and page 13 to think about the futures products you are interested in and what information you need to know and record this information.

Chapter 2 Take your trade plan to the next level: In this section (pages 8-9), you will focus on yourself. Just as important as understanding the products, you must understand yourself, trading style and tolerance for risk. Understanding your tendencies will help guide your trading strategy.

Chapter 3 Practice what you’ve learned: This is where your learning is put into practice. Use our Trading Simulator to implement your own strategies and review their outcomes. Take notes and learn from your experiences. A template has been provided, but you may want to build your own spreadsheets to record your trading activity.

Cotton Futures

What you'll learn

The structure and specifications of cotton futures contracts, including tick size, contract size, and expiry

Key drivers of cotton prices, including global supply and demand, weather, and trade policies

How producers, manufacturers, and traders use cotton futures to hedge price risk

Techniques for applying technical and fundamental analysis to cotton markets

Trading strategies tailored to the volatility and seasonality of soft commodities like cotton

Cocoa Futures

What you'll learn

The fundamentals of cocoa futures contracts, including contract size, tick value, and delivery months

Key price drivers such as crop yields, political risk in producing countries, and global demand

How to use cocoa futures for hedging, speculation, or long-term investment strategies

Methods for conducting technical and fundamental analysis specific to soft commodities

Strategies for navigating the unique volatility and seasonality of cocoa markets

Coffee Futures

What you'll learn

The structure of coffee futures contracts (Arabica vs. Robusta), including lot size, tick value, and settlement

Key factors driving global coffee prices, such as weather, origin risk, and demand cycles

How commercial players (growers, roasters, importers) use coffee futures for hedging

How to apply technical and fundamental analysis to soft commodity markets

Effective trading strategies for volatile and seasonally-driven markets like coffee

Wheat Futures

What you'll learn

The basics of wheat futures contracts, including tick size, margin requirements, and contract expiration

Key market fundamentals affecting wheat prices: weather, harvest cycles, global supply, and trade flows

How producers and traders use wheat futures for hedging and price risk management

Techniques for analyzing wheat markets using both technical and fundamental tools

Practical trading strategies tailored to the unique characteristics of the wheat market

Soybean Futures

What you'll learn

The structure and mechanics of soybean futures contracts, including tick size, margin, and expiration

Major market drivers affecting soybean prices, such as weather, global trade, and crop reports

How to use soybean futures for hedging, risk management, and portfolio diversification

Techniques for technical and fundamental analysis specific to agricultural markets

Practical strategies for trading soybean futures, from short-term setups to long-term positioning

Corn Futures

What you'll learn

The fundamentals of corn futures and how they are traded on exchanges like CBOT

Key factors that influence corn prices, including supply, demand, weather, and global markets

How to read and interpret a corn futures contract (contract size, tick value, expiration dates)

Risk management strategies using corn futures, including hedging and stop-loss techniques

How to analyze market trends and apply technical and fundamental analysis in corn futures trading

Trading Calculators

What you'll learn

How to use different types of trading calculators, including pip, margin, profit/loss, and position size calculators

How to accurately calculate risk and reward before entering a trade

How to determine the correct position size based on account balance and risk tolerance

How to calculate margin requirements based on leverage and instrument type

How to integrate calculator results into your overall trading strategy and risk management plan

What is xStation

What you'll learn

How to navigate the xStation platform and customize your trading workspace

How to place, manage, and close trades using different order types

How to analyze charts using technical indicators and drawing tools

How to use built-in tools like the trading calculator and risk management settings

How to access and apply real-time news, market sentiment, and heatmaps in your trading decisions

What is cTrader

What you'll learn

A student learning about cTrader will gain a comprehensive understanding of how to navigate and use the platform effectively for trading. They will learn how to place and manage trades, use advanced charting tools, customize layouts, and analyze market data. Additionally, they’ll explore automated trading with cAlgo, understand Level II pricing, and practice risk management using built-in tools. By the end of the course, students will be equipped to trade confidently and efficiently on cTrader.

Introduction to Futures

What you'll learn

This course is designed for you. Dive into the basics of futures contracts, how contracts trade on a futures exchange, the different ways customers use these instruments and the benefits that futures provide.

Master the trade

What you'll learn

Master the Trade: Futures is a course designed for new traders to increase their understanding of futures contracts and strategies for trading. This course brings together industry professionals so you can hear their perspectives on trading, learn about their strategies, and see how they approach various trading scenarios.